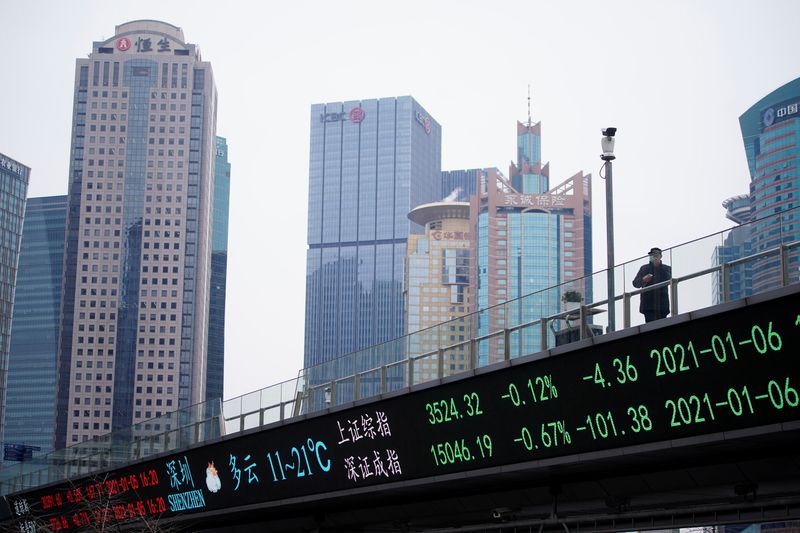

(Bloomberg) -- Chinese stocks in Hong Kong retreated after a historic two-day surge as investors assessed the feasibility of Beijing’s pledge to stabilize financial markets and any risks stemming from its close ties with Russia.

The Hang Seng China Enterprises Index lost as much as 2.6% in early trading on Friday. It rose 21% in the previous two sessions, the most since 1998. The Hang Seng Tech Index slid 4.1%, with Bilibili (NASDAQ:BILI) Inc. leading the decline.

Investors are taking a step back after rushing in to buy in the past couple days, as several concerns remain -- including the risk of possible U.S. sanctions on China given its ties with Russia. China’s muted response to Russia’s invasion of Ukraine has hardened views within the U.S. administration that President Xi Jinping may be moving closer to supporting Moscow as the conflict continues, according to several people familiar with the matter.

Beijing denies that it has tacitly backed the invasion and Chinese officials have rejected U.S. reports that Russia asked China for financial and military assistance shortly after touching off the war, labeling them disinformation.

READ: Biden Team Hardens View of China Tilting Toward Putin on Ukraine

Investors will thus be keenly watching the planned meeting this evening between Xi and U.S. President Joe Biden.

While Beijing’s concerted effort to shore up confidence brought a knee-jerk jump in equities, skeptics have sought concrete policy steps before calling an end to the rout. A gauge of Chinese stocks traded in the U.S. also cooled off overnight, falling 4.6% after a 33% surge in the previous session.

On the positive side, expectations are growing for the People’s Bank of China to soon take easing steps to spur the economy, which may aid market sentiment. A growing number of economists anticipate banks will lower their quotes for the loan prime rate, the de facto benchmark lending rate, when it’s announced by the PBOC Monday.

©2022 Bloomberg L.P.