After a decline in June, gold prices surged 4% in July 2024 to close at US$2,426 per ounce. Looking ahead, while August is typically a strong month for gold, the precious metal faces crosswinds from the Federal Reserve’s Jackson Hole symposium, the US elections, and weak earnings in the tech space.

These events are expected to sustain uncertainty rather than provide any clear resolution, favouring gold as a safe-haven asset amid ongoing share market volatility.

Gold hits all-time in July

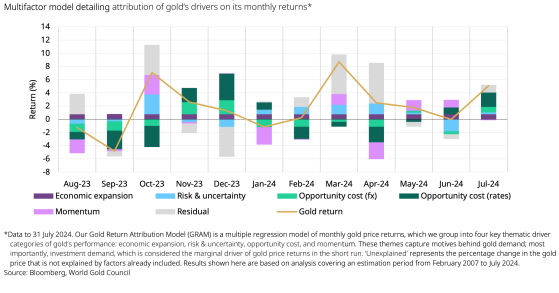

According to the World Gold Council’s Gold Return Attribution Model, the reasons for the June price rally — which included hitting an all-time high mid-June — was primarily due to declining 10-year Treasury yields, as well as the weaker US dollar. Notably, gold didn't appreciate against the Japanese yen, which saw a strong rally likely due to a carry trade unwind.

There was a significant spike in the VIX volatility index in early August — the third largest on record — triggered by a Bank of Japan rate hike, de-leveraging, and weak US employment data that resulted in sharp declines in indices. And while some recovery has occurred, the World Gold Council says a full return to pre-selloff exposure could take some time.

August is a pivotal month for gold

August is shaping up to be a pivotal month for the gold market, with several key events set to influence its performance. Gold typically benefits from supportive seasonal factors in August, particularly with bond yield weakness.

The Fed’s upcoming Jackson Hole symposium, held August 22-24, presents downside risks. The market has grown increasingly dovish, with rate cuts expected at the September 18 FOMC meeting based on weak US economic data. However, given the still healthy US economy and the chance the Fed takes a cautious stance on rates before the election, gold may face pressure.

On the other hand, gold could be supported if the second quarter market sell-off due to disappointing earnings — particularly from tech giants like Nvidia — continues or accelerates in late August.

Lastly, while US political shifts show a narrowing Republican lead, both parties' policies are generally supportive of gold.

While those are the three key factors that could influence the gold price in August, the World Gold Council added that gold could receive a boost from increased buying in India, following a cut to import duties.

Read more on Proactive Investors AU