Cadoux Ltd (ASX:CCM, OTCQB:FYIRF) has moved quickly to obtain feasibility and engineering studies for its critical mineral production strategy, nearing completion of Phase 1 activities for its high purity alumina (HPA) project and advancing to the engineering phase in a feasibility study for its Minhub rare earths processing project.

The company is concurrently developing a small-scale HPA production plant project and its Minhub mineral separation plant, which will also produce mineral sands concentrates and targeted rare earth minerals.

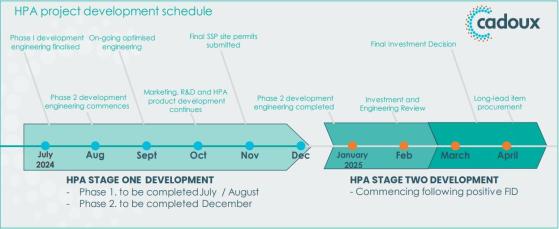

HPA Project nears Phase 2

Cadoux is about to begin Phase 2 activities for its HPA production plant, beginning with engineering services and market outreach.

Permitting for the plant, which will be built in Kwinana, Western Australia, is also advancing at pace, and Cadoux is adding to its organisational structure and expertise as development requires.

Minhub Mineral separation plant

Cadoux also intends to develop the Minhub Project in three stages; the first stage will target 250,000 tonnes per year of mineral sands concentrate (MSC), ramping up to 500,000 tonnes in Stage 2 and 750,000 tonnes in Stage 3.

The company expects an ongoing feasibility study for the project, which incorporates both stage 1 and 2, to be completed by the end of the calendar year.

The engineering phase, currently underway, is being led by IHC Mining, and studies and permitting for the intended project site in Darwin are complete.

All in all, Cadoux has made strong progress in developing its mineral processing projects, while also maintaining a keen focus on environmental, governance and social (ESG) issues.

The company had a focus on ESG education in particular this quarter, hosting internal workshops, promoting good governance at KPMG Australia’s UNAAWA SDGF Forum, attending workshops by the Critical Minerals Association Australia and increasing communication through social media channels while actively responding to stakeholder feedback.

Cadoux ended the June quarter with $4.8 million in cash, having spent $2.2 million of the forecast $2.5 million on feasibility study deliverables thus far.

Read more on Proactive Investors AU