Buru Energy Ltd (ASX:BRU, OTC:BRNGF) has raised about A$5 million in a strongly supported placement at 11.5 cents per share to fund ongoing appraisal and development of its Rafael gas and condensate discovery in the Canning Basin of Western Australia.

The placement attracted significant interest, securing investments from both existing major shareholders and new institutional and professional investors.

Alongside the placement, the company has also launched a share purchase plan (SPP) for its existing shareholders, allowing them to invest at the same price as the placement.

This reflects strong market support for Buru Energy's direction and strategy in advancing the Rafael project.

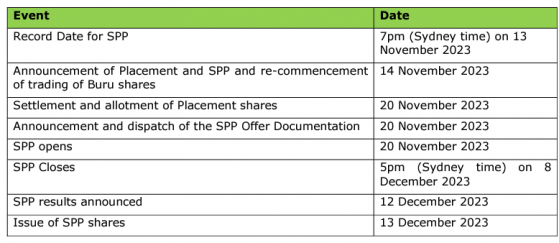

Indicative dates for the placement and SPP.

“Pathway to commercialisation”

Buru CEO Thomas Nador said: “The strong support of our major shareholders and new institutional investors for this capital raising reflects the progress we have made on the delivery of our structured program of appraisal and definition of commercialisation pathways of our very exciting Rafael discovery.

“We have demonstrated that there is a pathway to commercialisation for all realistic resource appraisal outcomes.

“We are also systematically progressing our on-ground appraisal activity, having recently completed the Rafael 3D seismic acquisition on time and on budget with preliminary results expected to be available in late November.

“The development of the Rafael conventional gas accumulation can provide much-needed reliable energy for Northern Australia with a materially reduced carbon footprint compared to current systems.

“There is also the potential for clean ammonia production using low CO2 Rafael gas and utilising the significant carbon storage capacity identified by Buru in the Canning Basin proximate to the Rafael discovery.

“We are equally excited about our large exploration acreage applications for natural hydrogen and helium via Buru’s 2H Resources subsidiary, noting the highly encouraging recent initial success of our neighbours in South Australia.

“We are also pleased to provide our wider shareholder base with the opportunity to continue to participate in our journey through the SPP and look forward to their continued support.”

Use of funds

The funds raised will supplement Buru’s existing cash reserves and provide support for ongoing appraisal and development activities including ensuring that long lead items required for the planned 2024 appraisal drilling program are available.

Lead times for procurement of oilfield equipment can be up to 12 months and to ensure these are available for planned drilling programs, commitments are required in a timely fashion.

The company is confident that the commitments for long lead items facilitated by this capital raising will ensure that the necessary well equipment is available as required for the 2024 drilling program.

The remainder of the funds from this capital raising will be applied towards costs associated with drilling program planning as well as regulatory and environmental approvals, ongoing native title negotiations and community engagement as part of progressing the appraisal and development planning of the Rafael discovery, as well as for general working capital purposes.

Placement summary

Wilsons Advisory acted as lead manager for the placement of new institutional and professional investors.

The placement price of $0.115 per share represents a 14.81% discount to the closing Buru trading price on November 9, 2023, and a 19.55% discount to the 10-day VWAP up to the last trading date before the announcement.

The placement shares are expected to be issued on November 20, 2023, under the company’s placement capacity pursuant to ASX Listing Rule 7.1.

SPP details

In addition to the placement, a share purchase plan (SPP) will also open on November 20, 2023.

The SPP will provide all shareholders, who held Buru shares on November 13, 2023, with a registered address in Australia or New Zealand, with the opportunity to apply for shares up to a maximum value of $30,000 at the same price as the placement.

The new shares issued under the placement and SPP will rank equally with existing Buru shares.

Read more on Proactive Investors AU