Bitcoin (BTC) took a plunge in early Wednesday trades, falling around 2% against the US dollar.

It follows a rather volatile six-day trading streak which saw the world’s largest cryptocurrency hit highs near $53,000 and lows near $50,500.

At the time of writing, the BTC/USD pair was swapping for $51,200, roughly 3% higher week on week.

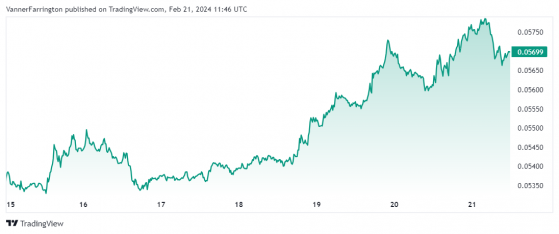

With bitcoin on a volatile streak, its closest competitor Ethereum (ETH) has pulled ahead, gaining over 7% on the ETH/BTC pair.

Ether gains on bitcoin – Source: tradingview.com

The market is weighing up the possibility of ether-based exchange-traded funds (ETFs) following the Securities and Exchange Commission’s January approval of bitcoin ETFs.

However, optimism for ether ETFs will face an extremely hawkish SEC boss Gary Gensler, who has shown little to no interest in assessing the viability of bringing other crypto assets apart from bitcoin onto the regulated exchanges.

In the news cycle, Circle Internet Financial, developer of the second-largest stablecoin USDC, announced that it is ditching support for the $28 billion dollar-pegged token on the Tron blockchain network.

In a blog post, Circle wrote: “As part of our risk management framework, Circle continually assesses the suitability of all blockchains where USDC is supported.

“Our decision to discontinue support for USDC on TRON is the result of an enterprise-wide approach that involved the business organisation, compliance and other functions across our company.

“This action aligns with our efforts to ensure that USDC remains trusted, transparent and safe - characteristics that make it the leading.”

Tron has previously been accused of being the blockchain network of choice for US-designated terrorist organisations.

The SEC has also accused founder Justin Sun of securities law violations.

Native Tron token TRX shrugged off Circle's decision to remove support, with TRX adding 7.5% week on week, outperforming both bitcoin and ether.

Binance’s BNB token and Polygon (MATUC) are also up in the high single digits.

Global cryptocurrency market capitalisation currently stands at $1.95 trillion, with bitcoin dominance at 53.2%.

Read more on Proactive Investors AU