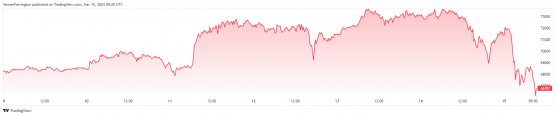

The world’s largest cryptocurrency bitcoin (BTC) was sent 5% lower against the US dollar this morning after achieving a fresh all-time high on Thursday.

The BTC/USD pair topped out at $73,777 before selling pressure and a bout of profit taking sent it back down to the $67,900 range at the time of writing.

Nonetheless, bitcoin remains in a strong position at 60% higher year to date, though its week-on-week position has dropped to the negative.

A confluence of factors has led to bitcoin’s exceptional 2024 performance, including the introduction of spot-bitcoin ETFs, interest rate reductions on the horizon and a bit of FOMO.

Furthermore, we have a supply-side shock just around the corner” with the upcoming Bitcoin Halving event, ETF Group’s founder and chief executive Tim Bevan stated.

Bevan maintains a $100,000 price target for the end of 2024, even if, as witnessed today, “we could see a lot of volatility”.

Bitcoin goes red week on week – Source: tradingview.com

Bitcoin was not the only crypto blue chip to fall in value on Friday. Ethereum (ETH), the second-largest cryptocurrency, plummeted nearly 6%, adding to speculation that the crypto markets are running hot right now.

In the broader altcoin space, Binance’s BNB token fell 8% overnight, with Ripple (XRP) dipping 10.5% and meme coins Shiba Inu and Dogecoin ratcheting up 16% in losses.

Global cryptocurrency market capitalisation currently stands at $2.51 trillion, with bitcoin dominance at 53.5%.

Read more on Proactive Investors AU