Like the broader risk markets, bitcoin (BTC) showed little reaction to Federal Reserve chair Jerome Powell’s hawkish comments on interest rates yesterday’s US-Canada economic policy forum.

“Recent data have clearly not given us greater confidence,” said Powell. Instead, they “indicate that it’s likely to take longer than expected to achieve that confidence”.

Powell warned against making bets on near-term interest rate cuts as the Fed is willing to hold on “for as long as needed” to keep the economy in check.

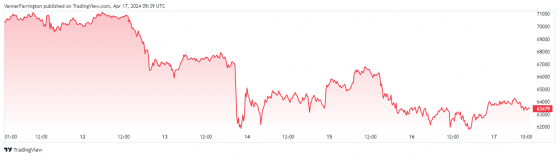

Bitcoin responded with a half a percentage point gain against the US dollar, before moving lower by the same amount this morning.

At the time of writing, the BTC/USD pair was swapping for $63,495, or approximately 8% lower week on week.

The focus is now on the big Halving event expected to occur this Friday, when the distribution rate of the cryptocurrency will be slashed in half.

With bitcoin already trading 50% higher year to date, an immediate post-Halving rally is not widely expected, though the disinflationary process is expected to support the cryptocurrency in the long term.

Bitcoin’s week-on-week performance – Source: tradingview.com

Ethereum (ETH) barely budged yesterday and remained subdued at $3,083 this morning, marking a 12% week-on-week fall.

In the broader altcoin space, Solana (SOL), Ripple (XRP) and Dogecoin (DOGE) have all dipped between 15-20%, while Binance’s BNB token has comparatively outperformed by dipping just 7%.

Global cryptocurrency market capitalisation currently stands at $2.31 trillion, with bitcoin dominance at 54.1%.

Read more on Proactive Investors AU