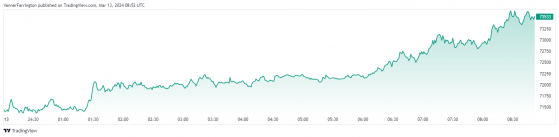

Bitcoin (BTC) historic rally continues to rumble on, with the benchmark cryptocurrency adding another 2.8% against the US dollar this Wednesday morning.

It brings the BTC/USD pair above $73,000 for the first time in the world’s largest cryptocurrency’s 15-year lifespan.

At the time of writing, bitcoin was swapping for a record $73,500, representing a 73% year-to-date gain.

Deutsche Bank (ETR:DBKGn) analysts cited a mix of sustained ETF inflows, the upcoming Halving event, impending central bank interest rate cuts and regulatory advancements as key catalysts.

Bitcoin surges to $73,500 – Source – tradingview.com

The UK recently made progress in regulating the cryptocurrency markets after opening the door to exchange-traded notes (ETNs), a crypto-linked derivative product available on the regulated exchanges.

Hector McNeil at HANetf called it “a good step forward” with some caveats.

“It means the UK is catching up with other markets in Europe now. However it is only for professionals so the bar is still too high,” he said.

“My view is there is a good regime for complex instruments, such as leverage ETFs, that are in place at money managers now and it gate keeps for retail clients who understand and can afford the risks of the asset class. That's the next step investors need in my opinion.

“UK is well behind Europe and the US here and I also believe the FCA is not in tandem with the government here who I believe are supporters of crypto.”

Ethereum (ETH), the second-largest cryptocurrency, penned its own all-time high of $4,093 on Tuesday and is currently trading slightly below this price point today.

In the wider altcoin space, Binance’s BNB token has shot up 40% week on week to $575, though a wide chasm remains between its ATH of $669 achieved in November 2021.

Avalanche (AVAX) has rallied 32% in the past seven days, with Toncoin (TON) adding nearly 60%.

Global cryptocurrency market capitalisation currently stands at $2.77 trillion, with bitcoin dominance at 53.9%.

Read more on Proactive Investors AU