Bitcoin (BTC) bulls are back in the driving seat after a 6% early-week rout sent the world’s largest cryptocurrency down to $64,500.

The dip coincided with a resurgent US dollar after hotter-than-expected US jobs data caused the swap markets to price in fewer interest rate cuts for the year.

But Bitcoin has since stabilised, with the BTC/USD pair adding green candlesticks over the past two days.

At the time of writing, bitcoin was changing hands for around $66,310.

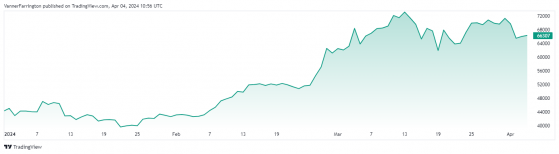

Bitcoin is up 67% year to date – Source: tradingview.com

Bitcoin ETF inflows are contributing to market stability. Per Farside data, $133 million entered the ETF market yesterday, with year-to-date net cash inflows totalling more than $12 billion.

Ethereum (ETH), the second-largest cryptocurrency, has cut a similar path by retracing some of its early-week losses. The ETH/USD pair still remains 7% lower week on week and is currently swapping for $3,341.

In the wider crypto space, Dogecoin (DOGE), Cardano (ADA) and Avalanche (AVAX) have all penned double-digit losses over the past seven days, while BNB is one of the few blue chips to post weekly gains (albeit less than one percent).

Global cryptocurrency market capitalisation currently stands at $2.51 trillion, with bitcoin dominance at a flat 52%.

Read more on Proactive Investors AU