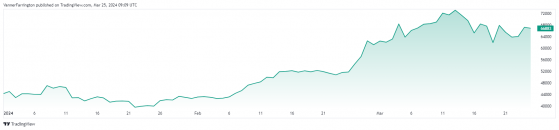

Bitcoin surged against the US dollar on Sunday, but has failed to sustain any momentum this morning, dipping around 0.3%.

The world’s largest cryptocurrency has come off from all-time highs of nearly $74,000 in the middle of March to trade below $67,000 at the time of writing.

A bout of profit taking and some notable outflows from bitcoin exchange-traded funds are two of the main culprits.

According to Farside Investors’ handy bitcoin ETF tracker, net outflows added another $53 million on Friday after seeing more than $800 in outflows in the first four days of the week.

The hype factor surrounding bitcoin ETFs, which were introduced to the market in January, could be on the wane, though net inflows since 10 January remain above $11 billion.

Despite the near-term losses, year-to-date performance is still strong, with the BTC/USD pair remaining more than 58% in the green.

Bitcoin’s year-to-date performance – Source: tradingview.com

Week on week, bitcoin is down 1.2%, while the second-largest cryptocurrency Ethereum (ETH) is off 3.5%. The ETH/USD pair is currently swapping for $3,444.

In the broader altcoin space, Dogecoin (DOGE) has reared ahead, adding 16% week on week, while Binance’s BNB token and Ripple (XRP) are also in the green.

Global cryptocurrency market capitalisation currently stands at $2.55 trillion, with bitcoin dominance at 53.3%.

Read more on Proactive Investors AU