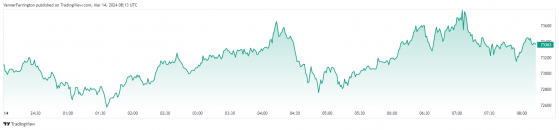

Bitcoin (BTC) penned another all-time high this morning after adding 0.8% against the US dollar.

The BTC/UDS pair reached as high as $73,658 in the early hours before edging back below $73,400 at the time of writing.

Bitcoin has put in an exceptional performance in 2024 due to a confluence of factors, including substantial inflows into newly approved exchange-traded funds, the upcoming Halving event, lower interest rates on the horizon and a bit of FOMO.

Year to date, the cryptocurrency is up more than 74%, with the latest Bloomberg data showing a new record for ETF cash inflows on Wednesday.

BlackRock’s iShares Bitcoin ETF (IBIT) added $848 million alone on Wednesday, bringing its assets under management above $15 billion to crack the top-100 ETF list.

Bitcoin’s year-to-date rally – Source: tradingview.com

As bitcoin continues to surge, the second-largest cryptocurrency Ethereum (ETH) has begun to cool off after hitting its own ATH on Tuesday.

ETH fell 0.9% against the US dollar in morning trades, bringing the ETH/USD pair to $3,940, or around 3.7% below Tuesday’s ATH.

Top risers in the broader altcoin space include Binance’s BNB token, which has added over 40% week on week, while Avalanche (AVAX), Solana (SOL) and Dogecoin (DOGE) are all up in the low 20% range.

Global cryptocurrency market capitalisation currently stands at $2.77 trillion, with bitcoin dominance at 53.8%.

Read more on Proactive Investors AU