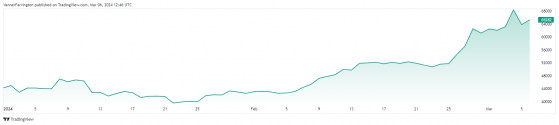

Bitcoin (BTC) fell back sharply on Tuesday after briefly touching the $69,000 all-time high.

By the midnight bell, the BTC/USD pair had slipped to nearly 7% to close at $63,700.

Bitcoin bulls appear to be having another punt again though, with the pair adding 1.8% to $65,000 at the time of writing.

Bitcoin’s remarkable 54% rally year to date is largely the result of the flurry of spot-bitcoin exchange-traded funds approved for trading on the US markets in January.

Speaking to Proactive today, Tim Bevan, chief executive of ETC Group, said the customer uptake on these ETFs have “been beyond anyone’s wildest dreams in terms of success”.

Bevan said up to $18 billion in cash has flowed into bitcoin ETFs since they launched in early January, with BlackRock’s iShares Bitcoin ETF seeing $750 million worth of inflows on Tuesday alone.

Bloomberg data further points to a walloping $10 billion in trading volumes across all ETFs on Tuesday alone, a new record for the market.

“We still see Bitcoin going through six figures, above $100,000 before year-end, and a number of people are predicting the peak of this cycle being $250,000 plus,” said Bevan.

Bitcoin is up 54% year to date – Source: tradingview.com

Ethereum (ETH), the second-largest cryptocurrency, has beaten bitcoin’s 2024 performance, adding 67% against the US dollar.

The ETH/USD pair was swapping for $3,796 at the time of writing.

As for the wider altcoin space, Shiba Inu (SHIB) has tripled in value in the past week amid a startling bull run on meme coins.

Dogecoin (DOGE) is up 65% , with other meme coins including Pepe and FLOKI also more than doubling in value.

Global cryptocurrency market capitalisation currently stands at $2.48 trillion, with bitcoin dominance at 53.9%.

Read more on Proactive Investors AU