Benchmark cryptocurrency bitcoin (BTC) added 0.6% against the US dollar in morning trades, bringing the BTC/USD pair to $67,300 at the time of writing.

It’s still below the $69,000 all-time high, but bitcoin bulls appear focused on reclaiming this price point after briefly touching it on Tuesday.

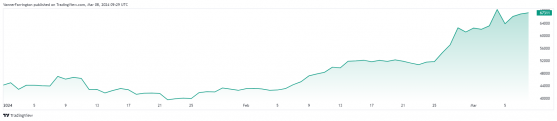

Bitcoin has ripped 59% higher year to date thanks to considerable cash inflows entering the bitcoin exchange-traded fund market.

Bitcoin’s year-to-date performance – Source: tradingview.com

Deutsche Bank (ETR:DBKGn) data published on Thursday showed that BlackRock’s iShares Bitcoin ETF has brought in $9.2 billion since being approved for trading in the US stock exchange on 10 January.

Though this is offset by $10 billion in outflows from the Grayscale Bitcoin Trust (GBTC), net cash inflows across all bitcoin ETFs are above $8.6 billion.

This has caused considerable buying support on the spot bitcoin markets, while the prospect of US interest rate cuts has further energised the risk markets.

Federal Reserve chair Jerome Powell told the Senate Banking Committee on Thursday that “we’re waiting to become more confident that inflation is moving sustainably at 2%. When we do get that confidence, and we’re not far from it, it’ll be appropriate to begin to dial back the level of restriction”.

In the meantime, bitcoin bulls will be attempting to break above the $68,000 resistance point, where a large block of sell orders are currently camped on Binance’s order book.

Ethereum, the second-largest cryptocurrency, has out performed bitcoin on a week-on-week basis, adding 15% against bitcoin’s 8%.

In the broader crypto markets, meme coins FLOKI, Shiba Inu (SHIB) and Pepe continue to rocket higher, with all three more than doubling in value over the past seven days.

Global cryptocurrency market capitalisation currently stands at $2.5 trillion, with bitcoin dominance above 53%.

Read more on Proactive Investors AU