Bitcoin (BTC) closed higher on Wednesday as the bulls attempt to reclaim the $69,000 all-time high briefly touched on Tuesday.

The world’s largest cryptocurrency added another percentage point against the US dollar this morning, bringing the BTC/USD pair up to $67,250 at the time of writing.

Bitcoin exchange-traded funds continue to bring in substantial amounts of cash, with BlackRock’s iShares Bitcoin ETF bringing in $9.2 billion alone.

This is offset by $10 billion in outflows from the Grayscale Bitcoin Trust (GBTC), though net cash inflows across all bitcoin ETFs are currently $8.6 billion in the green, according to Deutsche Bank (ETR:DBKGn) data released today.

Fidelity’s fund has received nearly $5.3 billion, said the bank.

Deutsche signalled continued optimism for the cryptocurrency market, stating: “As central banks start cutting interest rates from the decade-high levels seen in 2022, this is expected to fuel rising risk appetite and increased market liquidity.

“More investors will likely seek out higher-yielding alternative assets as treasury returns decline. This flow of capital into non-traditional investment classes like cryptocurrencies could further support an ongoing rally in digital currency prices.”

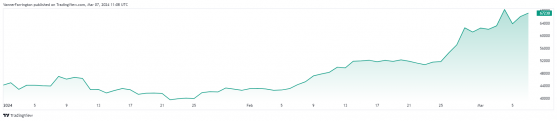

Year to date, bitcoin is up 59% with week-on-week performance at 7.5%.

Bitcoin’s year-to-date rally – Source: tradingview.com

Ethereum, the second-largest cryptocurrency, has added 9.6% week on week, with hopes of ether-based ETFs setting the market alight.

US regulators are expected to give their verdict on a spot-ether ETF application from VanEck on 23 May.

Meme coin’s continued to top the crypto movers table, with FLOKI adding 140% week on week, and Shiba Inu (SHIB) surging 136%.

Global cryptocurrency market capitalisation currently stands at $2.54 trillion, with bitcoin dominance at 53.8%.

Read more on Proactive Investors AU