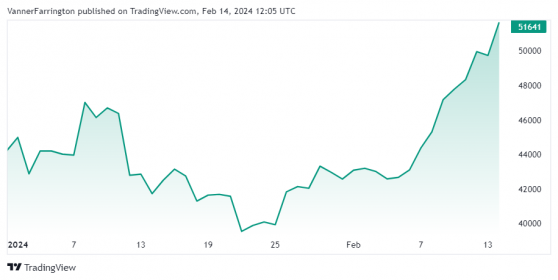

Bitcoin (BTC) powered above $51,000 for the first time in 26 months this morning after the world’s largest cryptocurrency penned a 3.3% gain against the US dollar.

It comes after a Tuesday wobble when the BTC/USD pair closed half a percentage point lower.

Despite the wobble, bitcoin has added nearly 20% to its spot price over the past seven days, in a bullish sign that the raft of bitcoin-based exchange-traded funds approved in January are starting to filter through to the spot market.

BlackRock’s iShares Bitcoin ETF (IBIT) has shot to the top of the global ETF leagues with over $4.7 billion in cash inflows, while Fidelity’s FBTC product has added over $3.8 billion, per Bloomberg data.

These healthy cash inflows are spurring buying support in the bitcoin markets, even if the Grayscale Bitcoin Trust (GBTC) continues to witness net outflows.

As a result of the rally, bitcoin’s market capitalisation is back above the trillion-dollar club, having flipped Warren Buffet’s Berkshire Hathaway (NYSE:BRKa) as the 10th largest global asset class.

As of midday, the BTC/USD pair was swapping for $51,640, marking a 22% year-to-date surge.

Bitcoin rally steams ahead – Source: tradingview.com

Ethereum (ETH), the second-largest cryptocurrency, was sent 4.45% higher against the US dollar this morning, with the ETH/USD pair swapping for $2,757 at the time of writing.

In the wider cryptocurrency space, Solana (SOL), Cardano (ADA) and Avalanche (AVAX) have added over 20% week on week, while BNB, Ripple (XRP) and Dogecoin (DOGE) have added high single digits.

Global cryptocurrency market cap currently stands at $1.92 trillion, with bitcoin dominance above 54%.

Read more on Proactive Investors AU