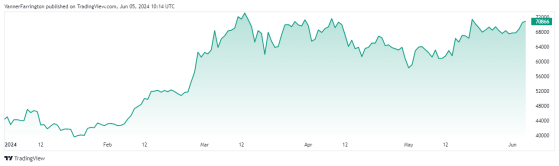

Bitcoin (BTC) is testing all-time highs again following a bullish Tuesday trading session.

The world’s largest cryptocurrency rallied 2.5% against the US dollar to close above $70,500. The pair made further gains this morning as was swapping for more than $70,800 at the time of writing.

Bitcoin hit an ATH of $72,800 in April, which is less than 3% from current spot prices.

Analysts point to a global shift in sentiment towards spot-bitcoin exchange-traded funds, with regulators in the UK, Hong Kong and most recently Australia following America’s lead in allowing the investment products onto the traditional stock market.

Matteo Greco, research analyst at Fineqia International Inc (CSE:FNQ, OTC:FNQQF), yesterday noted 14 consecutive trading days of net ETF inflows, with the overall net inflows year to date nearing $14 billion.

Whale activity is also contributing to bitcoin’s bullish behaviour.

ETC Group founder and chief strategy officer Bradley Duke attributed bitcoin’s gallop above $70,000 to the ‘whales’, classified as entities holding more than 1,000 bitcoins, who have been moving their holdings off exchanges into cold storage, signalling a long-term investment strategy.

Bitcoin is up over 67% year to date – Source: tradingview.com

Ethereum (ETH) has remained subdued in contrast to bitcoin, with the ETH/USD pair dipping 0.5% week on week compared to BTC/USD’s 4.3% of gains.

Global cryptocurrency market capitalisation currently stands at $2.63 trillion, with bitcoin dominance at 53.2%.

Read more on Proactive Investors AU