Street Calls of the Week

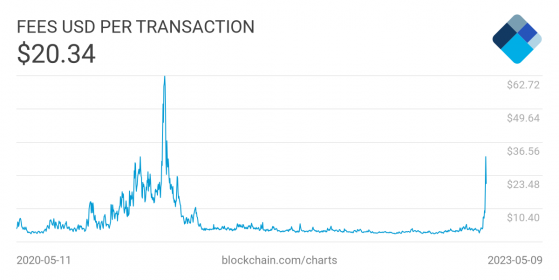

Bitcoin’s struggles with network congestion show no signs of abating, leading to some of the highest transaction fees seen on the bitcoin network in over two years.

Per transaction, the average cost of sending bitcoin from one account to another is over US$20 (£16), up to 1,000% higher than barely two weeks ago.

Source: blockchain.com

Meanwhile, a transaction backlog totalling more than 400,000 has piled up, while the average number of transactions per block has effectively doubled.

The reason for this unprecedented wave of congestion?

It all points back to what was initially a fairly innocuous protocol called Ordinals, created in January by developer Casey Rodarmor, which allows NFTs to be stored on the bitcoin base layer, something it was never designed to be capable of.

Ordinals has since turned into a tsunami of content flooding the bitcoin network, with up to five million inscriptions minted on the bitcoin blockchain, with half of them in the past week alone.

This is bad news for bitcoin users who want to use it for its original intent (decentralised transactions), but great news for bitcoin miners, who are seeing a significant surge in transaction revenues.

One thing it does not seem to be impacting is the actual price of bitcoin - at least not in a positive way.

For the fourth straight day, BTC/USDT closed lower on Tuesday with the pair dipping 0.15% to close around the US$27,600 price point with an even spread of long and short liquidations on the futures market.

The pair fell slightly more in this morning’s Asia trading session, hovering around US$27,550 at the time of writing.

Where will bitcoin go after the inflation read? – Source: currency.com

Investors are mulling their next move in anticipation for this afternoon’s inflation read in the US.

The market has inflation staying at 5%, though a downside surprise could act as a positive catalyst for the crypto markets.

For the moment, BTC/USDT support is pinned to the flat 27k price point, with resistance pitched at 28k and US$28,200, per the Binance order book.

Ethereum trades are similarly subdued, with ETH/USDT closing less than 0.1% lower at US$1,846 yesterday, before heading just below US$1,840 this morning.

Binance’s order book shows buying support at 1.8k and selling pressure at US$1,860.

Altcoin off-season remains

Despite bitcoin’s congestion woes, the benchmark cryptocurrency is still outperforming the altcoin blue chips, though the gap has tightened in the past day.

Week on week, bitcoin is 3.8% lower, compared to Ripple (XRP) at 7%, Cardano (ADA) at 5.8%, Dogecoin (DOGE) at 7%, Solana (SOL) at 5.5%, Polygon (MATIC) at 10% and Polkadot (DOT) at 6.5%.

Only Binance’s BNB token and Tron (TRX) have managed to outperform bitcoin on a week-on-week basis.

Bitcoin dominance (its size in relation to the entire cryptocurrency market, currently with a capitalisation of US$1.14tn) has fallen from a weekly high of 48.74% to 48.22%.