Despite achieving record production volumes at its WA Iron Ore operations and increasing copper production by 9% for the second consecutive year, with expectations of an additional 4% growth in FY25, BHP (ASX:BHP) Group Ltd (LSE:BHP, ASX:BHP) says it expects further volatility in global markets.

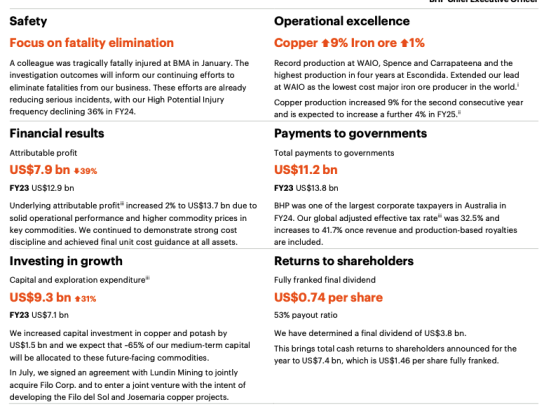

BHP delivered a full-year net profit of $US7.89 billion, down 39% due to one-off write-downs (a $US2.7 billion write-down of Western Australian nickel and a $US3.8 billion charge related to the Samarco dam failure), and issued a trimmed final dividend of 74 US cents per share, reflecting a 53% payout ratio.

The company announced a US$1.8 billion increase in revenue, largely driven by higher realised prices for iron ore and copper. Sales volumes for these commodities also rose by 3% and 5% respectively.

Growth was partially offset by lower prices for energy coal and nickel, as well as reduced steelmaking coal volumes following the divestment of Blackwater and Daunia on 2 April 2024.

BHP also noted that it faced a global inflation rate of around 4%, primarily due to increased labour costs.

Despite this, BHP benefited from lower costs for commodity-linked raw materials such as diesel and acid. Its focus on productivity initiatives and cost discipline helped mitigate these ongoing cost pressures, with unit costs increasing by about 2.9% across major assets.

However, volatility remains.

“In recent decades, we have seen global economies and supply chains come together and support sustained economic development.

"Today, we are seeing more turbulence, tension and polarisation in the geopolitical landscape,’’ chair Ken MacKenzie said.

“We expect economic conditions to remain challenging in FY2025 as geopolitical issues continue to create volatility and impact global markets, security and trade.’’

China’s stop-start recovery having an impact

eToro market analyst Josh Gilbert mirrors Mackenzie’s sentiments saying BHP’s performance in the coming financial year will depend, in part, on China.

"BHP has faced a challenging environment this year, with China’s stop-start recovery leading to significant volatility in global commodity prices. Iron ore, in particular, has slumped by over 26% this year, reflecting the broader uncertainty.

“Despite these headwinds, copper remains a key focus for BHP. The company saw a 9% year-over-year increase in copper production, supporting a 2% rise in underlying profit, which beat estimates. However, net income fell by 39%, missing expectations due to an impairment on its Nickel West operation and charges related to the Samarco dam failure.

“In the near term, BHP's performance will largely depend on China's economic trajectory, as a slowing economy and a struggling property market continue to pose challenges. Nevertheless, BHP's status as the world's lowest-cost iron ore producer gives it a competitive edge, allowing it to maintain strong margins and navigate current market volatility more effectively."

Focus on growth

BHP continues to invest in copper projects, with developments in Chile, Australia, and new acquisitions in Argentina.

In iron ore, studies to expand output are expected to conclude in the 2025 calendar year.

The Jansen potash project in Canada is ahead of schedule, with production anticipated in just over two years. However, the Western Australia Nickel operations have been temporarily suspended due to global oversupply.

“With the company cutting its full-year dividend, BHP's focus on growth is clear, a signal that CEO Mike Henry is exploring acquisition opportunities,” Gilbert said.

“However, finding the right fit won't be easy or cheap, as demonstrated by the failure of BHP's $49 billion bid to acquire Anglo American (JO:AGLJ) earlier this year. Still, opportunities will likely arise as other companies in the sector struggle with price volatility. Copper is expected to remain a primary acquisition target, given its critical role in the global energy transition.

“While shareholders may be disappointed by the dividend cut for the third consecutive year, especially with rival Rio Tinto (ASX:RIO) leaving its dividend unchanged, it could prove to be a smart decision. If BHP can deploy this capital wisely over the next 12 months, the long-term benefits could outweigh the short-term disappointment."

Riding out the challenges

An expected increase in copper production by 4%, after it rose 9% with record production at Spence and Carrapateena and the highest production at Escondida in four years, could see BHP ride out the challenges.

CEO Mike Henry pointed to compelling fundamentals.

“The effectiveness of recently announced pro-growth policies will be an important contributor for the country to achieve its official 5% growth target,’’ Henry said.

“India is set to continue as the world’s fastest-growing major economy.

“We anticipate developed economies will face gradual relief from the lingering effects of higher interest rates in coming years.’’

BHP also reported a tragic fatality at BMA in January and is focused on improving safety.

Female participation in the workforce has reached 37%, and Indigenous procurement spending exceeded US$600 million.

Operational greenhouse gas emissions have been reduced by 32% from FY20 levels, with a detailed decarbonisation plan set for 2050.

Read more on Proactive Investors AU