Aurumin Ltd (ASX:AUN) is expanding its footprint at the 881,000-ounce Sandstone gold asset in WA thanks to a deal that will see it acquire two exploration tenement applications.

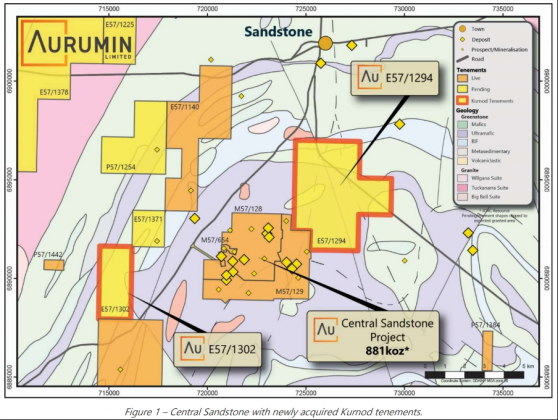

The gold stock has agreed to buy private company Kurnod Pty Ltd, leveraging its exposure to the E57/1294 and E571302 tenements — located right on the doorstep of Aurumin’s cornerstone Sandstone asset.

Aurumin managing director Brad Valiukas said: "We are pleased to be further expanding our footprint in the Sandstone region with these tenement applications, including a great addition directly adjacent to Aurumin’s existing mining tenements at Sandstone.

“The tenements, when granted, will provide additional exploration opportunity, as we focus on generating critical mass for future production at Sandstone.”

A closer look

Both of Aurumin’s new tenement applications sit within the Youanmi Terrane Greenstone — a proven exploration and production district.

Application E57/1294 adjoins Aurumin’s Central Sandstone mining tenements to the northeast and contains the Hacks Creek Structure, which runs north-northwest through the length of the tenement.

This property has mainly seen first-pass regional exploration, including surface sampling and wide-spaced reconnaissance drilling.

Meanwhile, application E57/1302 further consolidates the greenstone trend that hosts the Bellchambers, Bulchina and Golden Raven mineralisation.

The tenement remains largely undrilled, with only six known holes completed to date.

Given it’s still early days for both tenement applications, Aurumin is compiling and validating data for the project areas, including data sourced from open file reports and from the historical Troy Resources Database, which was inherited as part of the Sandstone Project acquisition.

In exchange for the properties, Aurumin will pay up just more than A$32,000 in cash, A$1 million in AUN shares and a 1% net smelter return royalty.

Regional focus

New additions to Sandstone’s regional portfolio come at a pivotal time for the gold stock.

Back in late May, Aurumin announced plans to drill nine regional open pit gold targets in an attempt to boost Sandstone’s overall resource.

The company’s Sandstone Project, together with the Birrigrin and Johnson Range projects, form the 946,000-ounce Sandstone gold operations, just over 500 kilometres from Perth.

Kicking off in June, Aurumin’s first-pass exploration campaign included 44 holes across 5,000 metres, following up on geochemical and structural targeting at Sandstone.

At the time, Valiukas said the program was aimed at transforming targets into deposits that could support future operations.

“We continue with a clear focus on generating the critical mass for future production, and on the mining leases is a great place to add ounces,” he explained.

Read more on Proactive Investors AU