Aura Energy Ltd (ASX:AEE, AIM:AURA) has fielded some promising phase one drilling results from its Tiris Uranium Project in Mauritania.

The project, 1,200 kilometres northeast of Nouakchott, Mauritania, is renowned for its calcrete-type uranium mineralisation, which is typically found within weathered granite or colluvial gravels.

New uranium mineralisation

The company is confident that the results reveal significant new uranium mineralisation and highlight the potential for resource growth beyond the current estimate of 58.9 million pounds of U3O8.

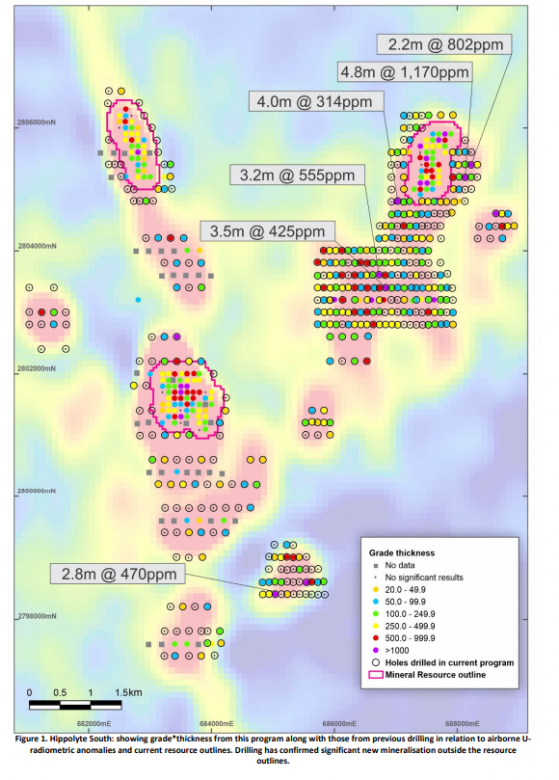

Exploration has uncovered high-grade mineralisation across a 6-square-kilometre area at Hippolyte South, with results indicating extensions in multiple directions and the area remaining open for further exploration.

The drilling results include notable intersections such as 4.8 metres grading 1,170 parts per million (ppm) U3O8 and 2.2 metres grading 802 ppm U3O8, among several others, showcasing the high-grade nature of the newly identified zones.

Aura's recent exploration endeavours have expanded the mineralisation at Sadi over a 1.2-kilometre stretch to the south and west, and have linked previously separate resource areas at Hippolyte West C.

Unveiled new potential

These findings have not only broadened the known extent of uranium mineralisation but have also unveiled the potential of low-strength radiometric anomalies, which were previously overlooked, thereby significantly enhancing the exploration prospects of the Tiris East area.

The ongoing phase two drilling aims to follow up on these results, further defining mineralisation and extending mineralised trends.

Aura Energy's management is confident in the project's continued resource growth and the potential to maintain low exploration costs.

The recent Front End Engineering Design (FEED) study outlined a near-term, low-cost uranium project with robust economics, including a net present value (NPV8) of US$ 366 million and an internal rate of return (IRR) of 43%.

Potential to grow resources

Aura managing director and CEO Andrew Grove said: "The drilling results are excellent and clearly demonstrate the significant potential to grow the mineral resources at Tiris beyond the current 58.9 million pounds U3O8.

“Two large areas of new mineralisation have been defined during the initial phase of drilling at both Hippolyte South and Sadi. Further, drilling has defined extensions to known mineralisation throughout the project area.

“The fact that low‐level radiometric anomalies have delivered potentially economic mineralisation significantly increases the exploration potential of the areas that were not considered prospective previously.

“Some of the 13,000 square kilometres of new tenement applications also overlie large radiometric anomalies adjacent to our current resource areas at Tiris East, further demonstrating the huge potential of the region.

“The recently released FEED study demonstrated excellent economics for a low‐cost 2 million pounds U3O8 per annum near-term uranium mine with a 17‐year mine life based on the current mineral resources.

"There is significant optionality in the project design for a modest capital investment to increase the production rate to make the most of any new economic resources.

“We are looking forward to the future drilling results and updating the mineral resource estimate in the second quarter of 2024.”

Read more on Proactive Investors AU