The ASX has closed the day in the red, shedding 0.41% or 30.4 points and setting a new 20-day low.

Energy was the main culprit with the sector down 1.08% as a strong US dollar made oil more expensive for global buyers, even as tensions escalate around the Red Sea’s trading routes.

Woodside shed 1.35%, Santos 0.91%, Whitehaven Coal (ASX:WHC) 1.8% and Chevron (NYSE:CVX) 2.43% as the heavyweights fell hard.

Real Estate (-0.92%) and Materials (-0.85%) also fell, while Utilities bucked the trend to add 0.72%, joined only by Info Tech (+0.50%) and Health Care (+0.34%).

As for commodities, oil dipped 1.17%, but all the precious metals suffered today with palladium (-3.74%) taking the biggest hit.

Copper, aluminium and lead faired better, notching gains of between 0.63% and 0.24%.

Fed resists rate cut rhetoric

Capital.com senior market analyst Kyle Rodda joins us once again to discuss losses on Wall Street overnight, the rising US dollar and China’s potential for recovery.

“The US Federal Reserve’s Christopher Waller said interest rate cuts need to be done 'methodically and carefully' and that there won’t be the need to cut interest rates as aggressively as in the past,” Rodda wrote.

“The pushback on (at least imminent) cuts to the Federal Funds Rate sparked a shift in policy expectations as market participants continued to feel around for the probably timing and pace of interest rate reductions.

“The odds of a March cut are down from almost 80% on Friday to closer to 60% now. The total number of cuts baked in for 2024 also fell marginally but still implies roughly six. Yields rose, with the benchmark 10-year yield rising 12 points.

“Equities dropped on the news, and the US Dollar spiked, putting downward pressure on the G10 currency complex and commodity prices.

“When it comes to stocks, indices look quite richly priced and the juicing of valuations from rate cut expectations appears all but exhausted.

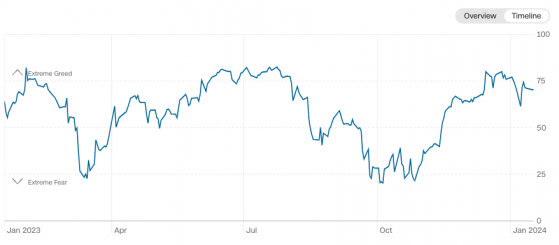

“A BofA survey showed investors had increased allocation to equities to a two-year high; the fear and greed index remains very close to extreme greed.”

Fear and Greed index:

“A resurgent Dollar (despite some soft Empire State Manufacturing data) is potentially shifting trends in currency and commodity markets,” Rodda continued.

“The delay in the timing of the first Fed cut is US Dollar positive, with the general shift in risk sentiment especially weighing on high-beta currencies like the AUD/USD.

“The AUD/USD fell more than 1% into the 65-handle as support at the 200-day MA looms. Commodity prices were broadly lower, with gold’s uptrend at risk of breaking down as its price falls through its 50-day moving average.

“Oil prices were lower despite further US strikes on Houthi assets in Yemen.”

AUD/USD:

Gold:

“Attention will be on China and its monthly data dump, which includes GDP figures this month,” Rodda wrote, “It is estimated that growth expanded to 5.3% q/y, while other growth partials are expected to expand roughly at the same rate as last month.”

Five at Five

Imugene receives positive early results, including a 'complete response', in Phase 1 VAXINIA study

Imugene Ltd (ASX:IMU, OTC:IUGNF) has fielded encouraging early results from its Phase 1 MAST (Metastatic Advanced Solid Tumours) trial.

Read more

Intra Energy Corporation identifies key lithium pathfinders in Maggie Hays Hill sampling

Intra Energy Corporation Ltd (ASX:IEC) has demonstrated the presence of pegmatites with key lithium pathfinder elements in rock chip samples collected from six outcropping pegmatites during a “brief field walk” at the newly acquired Maggie Hays Hill Lithium Project in WA.

Read more

Aeris Resources delivers resource update for Stockman’s Currawong and Wilga deposits

Aeris Resources Ltd (ASX:AIS, OTC:ARSRF) has delivered a revised mineral resource estimate (MRE) for its Currawong and Wilga deposits within the wholly-owned Stockman Project in northeast Victoria.

Read more

St George Mining expands Ida Fault exposure with new tenement acquisition

St George Mining Ltd (ASX:SGQ) increased its exposure to the highly prospective Ida Fault Zone with the recent acquisition of exploration licence E15/1687.

Read more

Torque Metals moves quickly on lithium drilling after completing Penzance Exploration Camp acquisition

Torque Metals Ltd (ASX:TOR) has moved swiftly on a lithium drilling campaign at the New Dawn Lithium Project after completing the acquisition of an extensive package of tenements in Western Australia dubbed the Penzance Exploration Camp.

Read more

On your six

AI 101: Large language models - a peek into the future

The advent of large language models (LLMs) marks a significant milestone in the field of artificial intelligence (AI), demonstrating remarkable capabilities in understanding and generating human-like text.

Read more

One to watch

FireFly Metals outlines growth potential at Green Bay Copper-Gold Project

FireFly Metals Ltd (ASX:FFM) managing director Steve Parsons sits down with Proactive’s Jonathan Jackson to talk about results from its recent drilling program at the Green Bay Copper-Gold Project in Canada.

Read more

Read more on Proactive Investors AU