Astral Resources NL (ASX:AAR) has projected free cashflows of about $740 million over a life-of-mine (LoM) of 11 years in a scoping study for its flagship Mandilla Gold Project in Western Australia’s Widgiemooltha greenstone belt.

The study, based on extraction of mineral resources in two granted mining leases, has determined that a 2.5 million tonnes per annum carbon in leach (CIL) processing plant with associated infrastructure provides the lowest capital and operating cost across the mine’s life.

It projects an average gold production target of 100,000 ounces per annum at an average feed grade of 1.30 g/t gold over the first 7.4 years, gradually reducing to 41,000 ounces at 0.50 g/t gold from treating lower grade stockpiles over the remaining 3.4 years.

The company estimates that $191 million will be needed to cover the capital and operating costs, from plant construction to gold production.

Convincing numbers

Modelled on a gold price assumption of A$2,750 per ounce, which is lower than the spot price for the past six months, the project is forecast to generate an unleveraged and pre-tax internal rate of return of 73% and net present value of $442 million based on a discounted rate of 8%.

Other compelling financial outcomes from the study include:

- Five-stage open pit design based on a A$2,100 per ounce gold price pit optimisation;

- Cumulative EBITDA of approximately $954 million over the life of the project; and

- Pre-tax and unleveraged payback period of approximately 0.75 years, from commencement of production.

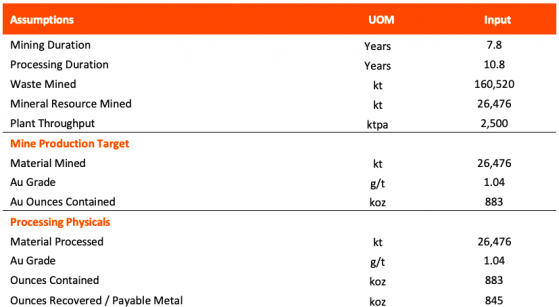

Key assumptions in the study.

“Highly profitable” operation

“We are pleased that the Mandilla scoping study has confirmed the potential for Mandilla to become a highly profitable standalone gold operation,” Astral Resources managing director Marc Ducler said.

“Mandilla is situated in the premier Goldfields region of Western Australia and is firmly established as one of the best free-milling, open pit resources in this district in both scale and quality of project.

“The study outlines compelling financial metrics for a Mandilla development, with projected free cash-flows of approximately $740 million over a life-of-mine of 11 years and a payback period of less than a year for total pre-production capital expenditure of approximately $191 million.”

Ongoing work

In the meantime, Astral is continuing with its exploration and evaluation activities at the Mandilla and Feysville gold projects.

At Mandilla, work will include both in-fill drilling to convert inferred resources to the indicated category as well as exploration drilling targeting further resource growth.

“Astral continues to advance exploration and resource definition efforts at Mandilla, as well as at the company’s nearby Feysville Gold Project, while simultaneously progressing pre-feasibility studies as it seeks to deliver on its strategy of building another quality Western Australian mining operation,” Ducler added.

Mandilla and Feysville location map.

Information sharing session

The ASX-lister will host a webinar on Friday, September 22, 2023, at 9am AWST/11am AEST to provide more information on the scoping study.

Click here to sign up for the session.

Read more on Proactive Investors AU