* Proceeds to be used to cut state debt by A$8 bln, create A$3 bln fund

* Western Power not to be foreign owned or controlled-state treasurer (Adds Ausgrid context, details of the IPO and quotes from WA treasurer)

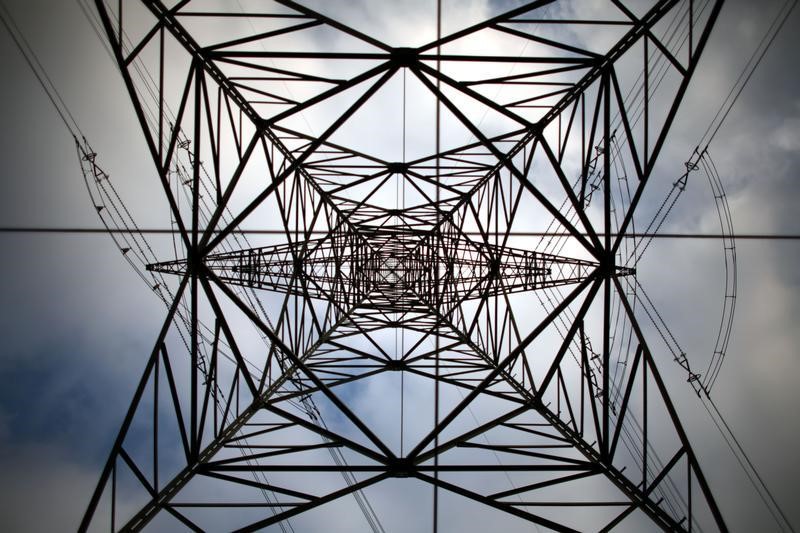

SYDNEY, Nov 30 (Reuters) - Western Australia state will sell a majority stake in its electricity grid via a public float to reduce the state's debt, but ensure the asset remains in Australian hands, state officials said on Wednesday.

The proposed public offering of Western Power, the state's electricity network, follows the sale of Ausgrid, a power network owned by New South Wales state, last month to a consortium of Australian pension funds.

That deal was agreed at a price lower than bids made by Chinese and Hong Kong suitors after Australia's treasurer Scott Morrison blocked the foreign bids, frustrating the bidders and spooking foreign investors. of the sale of 51 percent of Western Power would be used to reduce state debt by A$8 billion ($6 billion) and create an infrastructure fund worth A$3 billion, Western Australia's premier Colin Barnett said in a joint statement with state treasurer Mike Nahan.

Lobbying group Infrastructure Partnerships Australia has previously valued Western Power at A$15 billion.

Nahan said the government will retain 49 percent of the company, and aims to sell roughly 30 percent of the shares to Australian pension funds and 20 percent to retail investors.

"This model will address any national security concerns about foreign ownership. Western Power will not be foreign owned or controlled," he said.

The statement did not give an indication of the sale's timing, but a spokeswoman for Barnett said it was scheduled for 2018 or 2019, well after a state election slated for March 2017.

The state government, which is struggling with a downturn in revenue after the end of the resources boom, had flagged its intention to sell the asset in May. ($1 = 1.3362 Australian dollars)