Housing affordability in Australia has been a hot topic for some time, recently flaring up due to massive rent and housing price increases post-COVID-19 lockdowns.

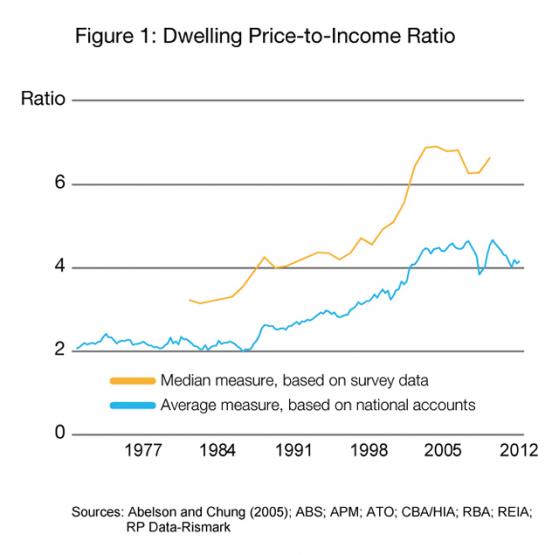

Affordability has broadly declined since the 1980s, with median price-to-income ratios almost tripling in that time.

In other words, average buying power in the housing market has fallen dramatically over the last three decades and housing has become functionally 300% less affordable in that time.

That doesn’t take into account recent hikes in price evaluations, as the numbers only cover to 2012.

Recent data indicates the average house price in New South Wales has jumped by $675,200 from March 2012 to March 2022, a whopping 123% increase.

The Australian Co-operative Housing Association (ACHA) and the Business Council of Co-operatives and Mutuals (BCCM) believe co-operative housing, or collective ownership of housing, could be the answer to the affordability crisis.

The ‘missing middle’

The two organisations have launched policies aimed at raising awareness about alternative housing models, calling for greater commitment by governments to include co-operative models in future spending to ensure at least 10% of all social housing stock nationally is co-operatively owned by 2033.

The policy blueprint was launched yesterday in Canberra at a housing affordability roundtable hosted by the Parliamentary Friends of Co-operatives and Mutuals.

Only 1% of social housing is currently co-operatively owned.

“Rental and equity co-op housing models are the missing middle for low to middle income Australians,” Business Council of Co-operatives and Mutuals chief executive Melina Morrison said.

“We cannot simplify the problems many Australians face in securing affordable housing to issues of supply. There are deep structural problems that require innovative solutions to allow for a fairer housing market.

“We have the evidence from overseas markets to demonstrate that co-operative housing contributes to a rich and diverse housing sector, offering security of tenure for people who are locked out of traditional ownership models.”

In essence, co-operative housing is a kind of social housing owned not by the government or a corporation but by a not-for-profit organisation made up of individual homeowners or contributors.

Wide-reaching benefits

Yesterday’s roundtable included a range of experts such as Dr Marcus Spiller from the Interim National Housing Supply and Affordability Council, Liz Thomas, ACHA chair and CEO, Common Equity Housing Limited (CEHL) and Peter Remfrey, chair, Police Bank.

Mutual banks also offered innovative schemes to assist essential workers and first home buyers into housing closer to where they work.

“It’s inconceivable to think that in Australia today there are many essential workers who cannot afford to live close to where they work,” Morrison commented.

Preliminary research findings presented at the round table show that active participation in housing co-operatives is linked to a range of beneficial outcomes for their members.

These benefits include:

- A sense of home, security, stability and safety;

- A sense of agency, voice and empowerment;

- Health and well-being, including that of children;

- Skills development, employment and education; and

- A strong sense of community, social networks, mutuality and reciprocity, and trust

By offering affordable housing options, co-op housing can also reduce strain on other social and public services while lowering overall demand for properties.

The research, which has been funded by ACHA and the Australian Research Council, will be released next year.

Australia lags behind

Co-operative housing is a common model overseas. In Zurich, Switzerland, 20% of all housing is managed by co-ops, while in Denmark rental co-ops house about 20% or one-fifth of the population. Sweden is a similar story, with 22% of all housing stock held in co-operative ownership models.

Mirroring those rates in Australia would put between 1.6 million and 2.4 million households into co-operative living, compared to just 5,000 at present.

ACHA is asking for at least 10% of funds from initiatives like the Social Housing Accelerator and the Housing Australia Future Fund and the expanded National Housing Infrastructure Facility to be allocated to building the co-operative housing sector.

Read more on Proactive Investors AU