Antipa Minerals Ltd (ASX:AZY) has increased the inferred mineral resource estimate (MRE) for the Calibre deposit within the Citadel Joint Venture Project in Western Australia’s Paterson Province, reaffirming the prospect as a very large-scale gold-copper-silver mineral system.

The Calibre deposit, which is 45 kilometres east of Rio Tinto’s Winu copper-gold-silver resource and Ngapakarra gold-copper deposit, is 68% owned by Antipa’s joint venture partner Rio Tinto (ASX:RIO) Exploration Pty Ltd, with Antipa holding 32%.

An updated Calibre inferred MRE, incorporating 2021 drilling results, now contains 2.5 million ounces of gold — a 19% increase from the previous 2.1 million ounces.

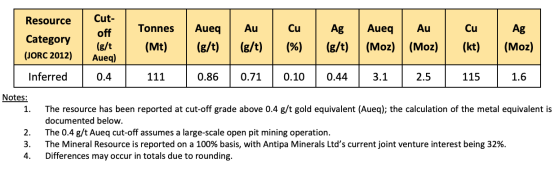

The inferred MRE now totals 111 million tonnes at 0.86 g/t gold-equivalent (0.71 g/t gold, 0.10% copper and 0.44 g/t silver) containing 3.1 million gold-equivalent ounces — comprising 2.5 million ounces of gold, 115,000 tonnes of copper and 1.6 million ounces of silver — using a 0.4 g/t gold equivalent cut-off grade.

Calibre mineral resource statement (JORC 2012) – August 2024.

The Calibre resource extends for around 1.4 kilometres and remains open along strike to the south, at depth and potentially across strike.

Calibre Deposit west-looking vertical projection showing all Calibre drill holes (including 2021 drilling) depicting gold and copper grade distribution.

“A potential large-scale open pit”

Antipa managing director Roger Mason said: “This update reaffirms that Calibre, which was discovered by Antipa, is a very large-scale gold-copper-silver mineral system with significant growth potential located in the rapidly advancing tier-1 Paterson Province.

“The scale of the Calibre deposit in conjunction with its off-the-shelf metallurgical characteristics and shallow, predominantly free-digging, post-mineralisation cover, should suit a potential large-scale open pit mining development scenario.”

Antipa’s overall Paterson Province strategy is to deliver greenfield discoveries and increase brownfield gold and/or copper resources, with the ultimate aim of generating a short- to medium-term production opportunity.

Rio Tinto-Antipa Citadel JV Project, including the Calibre and Magnum resources, Rimfire and Corker prospects; plus Rio’s Winu resource and Ngapakarra deposit, and a portion of the Antipa-IGO Paterson Farm-in including the Reaper, Poblano, Serrano and Grey gold-copper prospects.

The existing inferred MRE at the project’s Magnum deposit, just 1.3 kilometres from Calibre, provides an additional 340,000 ounces of gold, 57,800 tonnes of copper and 511,000 ounces of silver and remains open at depth and along strike to both the north and south.

The Calibre and Magnum deposits are part of the Citadel Project’s large 1,200 square kilometres of tenure, which is within 5 kilometres of Rio’s Winu copper-gold-silver project.

Calibre and Magnum together contain global inferred mineral resources of 127 million tonnes at 0.71 g/t gold, 0.13% copper and 0.51 g/t silver for 2.84 million ounces of gold, 173,000 tonnes of copper and 2.1 million ounces of silver.

Read more on Proactive Investors AU