Amazon.com Inc (NASDAQ:AMZN)’s market valuation has dipped below one trillion dollars for the first time in over two and a half years following a disappointing earnings season for big tech.

The e-commerce behemoth lowered its fourth-quarter guidance after missing revenue forecasts due to foreign exchange headwinds and US$2.5bn in international operating losses.

The company’s streaming service also faces trouble following a mixed reception to its one billion dollar Rings of Power series.

Shares dipped 16% after last Thursday’s earnings and kept dropping every consecutive trading day since.

Yet Amazon’s value managed to stay in the trillion club alongside fellow tech giants Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL).

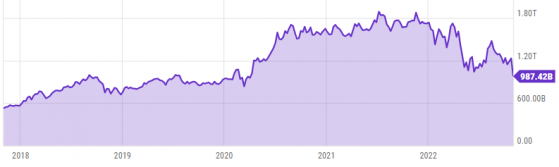

That was until the bell rang on Tuesday on a share price of US$96.79 and a market capitalisation of US$987.42bn, the lowest in over 31 months.

AMZN shares dip to 31-month lows, yet other tech competitors facing worse – Source: ycharts.com

Facebook (NASDAQ:META) suffered a similar fate last year following its fateful Meta rebrand.

Having briefly traded above US$1tn, Meta stocks tumbled… and kept tumbling. Today, Meta is worth only a quarter of what it was pre-rebranding.

But their issues a vastly different: Meta is trying to convince the world that its multibillion-dollar gamble on metaverse technology will pay off.

Amazon is facing more conventional issues: An overpriced US dollar that’s causing forex headwinds, and global inflation trends that are causing consumers to tighten their belts.

Amazon is hardly in dire straits: Revenues still increased 25% year of year, and its advertising segment is managing to outpace both Google and Meta.

But until the macro headwinds change direction, there could be more short-term pain to come for big tech.

Read more on Proactive Investors AU