Alligator Energy Ltd (ASX:AGE, OTC:ALGEF) is set to make key improvements to the Samphire Uranium Project’s economics following revisions to its scoping study.

The updated scoping study promises robust project economics, low environmental impact and considerable optimisation opportunities.

Robust economics

The update follows an enhanced mineral resource estimate for the Blackbush deposit reported on December 7.

CEO Greg Hall emphasised the projected financial performance for Samphire: “The updated scoping study outcomes have shown a continued improvement in Samphire Project economics as we increase resource mineralisation quality, increase production rate and refine the processing flowsheet and costs.

“An improving forward price assumption is also of great benefit. As major capital items were generally sized for a higher throughput in the initial scoping study, the relatively small capital increases were offset by reduced resource drilling during project construction, resulting in only a minor capital increase for this updated scoping study.”

Key highlights include a 69% increase in the post-tax Net Present Value (NPV8), reaching A$257 million, an improvement attributed to the upgraded annualised production target, which is now set at 1.2 million pounds (Mlbs) per annum, a notable increase from the previous 1Mlbs.

The updated study reveals a total uranium mining inventory of 17.5 Mlbs U3O8 at Samphire, with 74% originating from the updated indicated resource category.

The life of mine (LOM) production target has also been raised from 10.0 Mlbs U3O8 to 12.3 Mlbs, covering a 12-year period.

Project economics have been enhanced with a forecasted realised sales price of US$75 a pound U3O8 and an unchanged exchange rate of 70 cents (A$:US$). This has resulted in a substantial increase in the forecasted net project cashflow, now estimated at A$467 million.

Moreover, the initial capital expenditure is projected at a modest A$131 million, a minor increase to support the escalated production target.

Next steps

Alligator Energy is proceeding with its 2024 field recovery trial, aiming to further optimise technical aspects of the project. The trial is crucial for de-risking and refining the project's parameters.

The company will also focus on resource growth through exploration, targeting an extended LOM and increased annual production target.

“We will re-commence our resource expansion drilling around late January 2024 with a dedicated drill rig all year,” Hall said.

“Drilling will be initially focused on Blackbush deposit resource expansion to the east, north and west, which has the greatest impact on future project economics.

“This will be followed by a multi-year program of work to evaluate the 30% of palaeochannels which have some mineralised drill intersections and the ~60% of known palaeochannels that have no drilling.

“Our intent through the field recovery trial, expanded resource, feasibility study and in time mining lease approvals is to have a robust economic project ready to feed uranium into the growing long-term market later this decade.”

About the Samphire Uranium Project

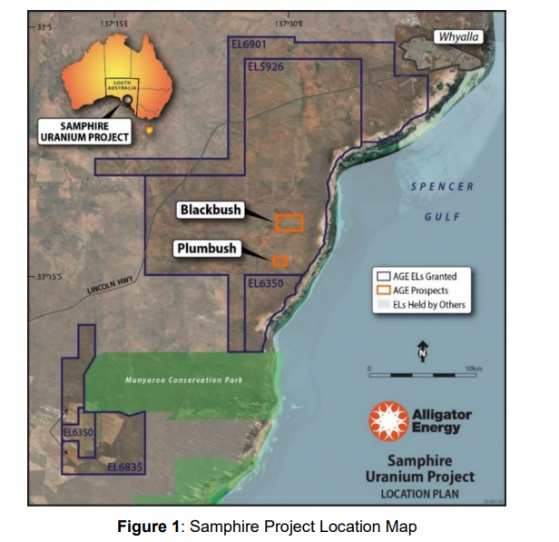

The Samphire Uranium Project, near Whyalla in South Australia, centres on the Blackbush Deposit.

The project includes the establishment of necessary infrastructure, production wellfields and an ISR (In-Situ Recovery) mining technique for uranium oxide production.

Read more on Proactive Investors AU