Street Calls of the Week

Alicanto Minerals Ltd (ASX:AQI) has received binding commitments for a placement to raise $3.15 million through the issue of 90 million shares at $0.035 each, with proceeds focused on funding its exploration program at the Falun Copper-Gold Project in Sweden.

The placement attracted strong demand from existing shareholders as well as new international and domestic investors, which Alicanto says reflects confidence in the company and the “highly prospective” Falun Copper-Gold Project.

Settlement is expected to occur on April 13, and Canaccord Genuity (TSX:CF, LSE:CF) (Australia) Ltd acted as lead manager of the placement.

Comprehensive exploration

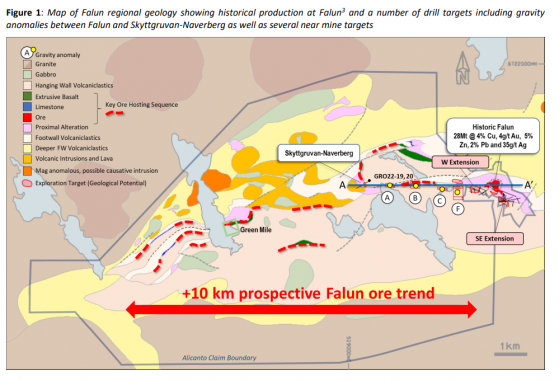

The boost to the company’s war chest will allow it to prosecute a comprehensive exploration campaign, which will include testing a 10-kilometre target-rich ore corridor at Falun.

The company is designing and submitting work plans for regulatory approval which will include the first modern application of surface electromagnetic techniques in the mine’s history.

Falun was a world-class mine that last operated in 1992 and produced 28 million tonnes at 4% copper, 4 g/t gold, 5% zinc, 2% lead and 35 g/t silver.

Since its closure, limited modern exploration or drilling has been done at the site.

High-priority Falun project

The success of recent drilling at Falun and due diligence investigations associated with its acquisition mean the company already has a number of key zones of mineralisation picked out for immediate follow-up.

Alicanto also plans to run a significant electromagnetic survey over highly prospective ground for extensions of the Falun mine between its initial drilling at Skyttgruven-Naverberg and the Falun mine.

This will allow the company to prioritise the best quality drill targets for follow-up diamond drilling.

Key areas of focus are expected to include a series of gravity anomalies that have never been drilled, found by high-resolution gravity survey after closure of the mine, as well as recent step-out drilling at Skyttgruvan-Naverberg, which included such results as:

- 5.3 metres at 6.8% zinc equivalent (84 g/t silver, 0.5% copper, 3.3% zinc, 1.2% lead);

- 2.9 metres at 14.7% zinc equivalent (194 g/t silver, 0.1% copper, 4.9% zinc, 7.6% lead);

- 6.8 metres at 9.7% zinc equivalent (114 g/t silver, 0.5% copper, 5.5% zinc, 1.0% lead, 0.13 g/t gold); and

- 3.9 metres at 11.3% zinc equivalent (20 g/t silver, 0.2% copper, 9.5% zinc, 1.5% lead).

Over at the Sala Project, the company continues to focus exploration efforts on several near-mine targets that have the potential for significant silver grades.

The Sala mine, which closed in 1908, produced 200 million ounces of silver at an average grade of 1,244 g/t silver and up to 7,000 g/t.

Alicanto managing director Rob Sennitt said: “We have made some excellent progress at Falun on the back of very limited investigations to date.

“The work we have done is supportive of our concept that the historical Falun mine is only a small part of a major mineralised belt stretching over at least 10 kilometres.

“The proceeds of the raising will enable us to refine and grow our high-priority targets ahead of a major drilling program to test this view.

“We are confident that this systematic and comprehensive approach will maximise our ability to unlock the true value of this highly prospective corridor around what was historically a world-class copper-gold mine.”