Alicanto Minerals Ltd (ASX:AQI) has finalised the acquisition of the Falun Copper-Gold-Zinc Mine in Sweden after satisfying due diligence and conditions precedent, gaining a 312-square-kilometre battery and precious metal asset with reportedly “world-class” credentials.

The Falun mine historically produced some 28 million tons at 4% copper, 4 g/t gold, 5% zinc, 2% lead and 35 g/t silver, and sits atop a 60-kilometre prospective limestone horizon.

AQI paid $200,000 in total for Falun – $50,000 in cash, and a further 3.6 million Alicanto shares worth $150,000 at the time of sale.

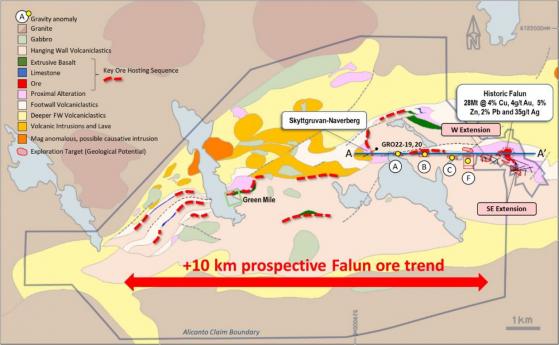

10-kilometre mineralised belt

“This is an outstanding acquisition for the company,” Alicanto managing director Rob Sennitt said.

“It allows us to consolidate the highly prospective tenure containing the world-class Falun mine into our plans for the exploration of the consolidated Falun Project.

“We have already identified significant gold and base metal mineralisation outside the previous mining voids.

“Most encouragingly, the data further supports the concept being developed by Alicanto that there is a major mineralised belt stretching over 10 kilometres on tenements now controlled by Alicanto, with excellent potential for future near mine discoveries.”

Alicanto geologists will now review historical data from the mine, which despite its reportedly “world-class” credentials, has had little follow-up with modern exploration techniques since mining operations ceased in 1992.

The company says its already identified several high-priority targets and unmined high-grade intersections, which will be investigated with an exploratory diamond drilling program.

Map of Falun regional geology identifying a number of drill targets including gravity anomalies between Falun and Skyttgruvan-Naverberg as well as several near mine targets.

Read more on Proactive Investors AU