Alchemy Resources Ltd (ASX:ALY) (FRA:45A) is well prepared for a very busy 2021 as newly installed chief executive officer James Wilson leads the company through "aggressive but targeted exploration".

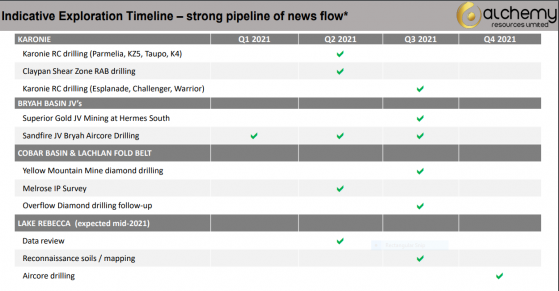

Wilson, who took the reins in 2021 at what has been described as an exciting time for the company, said the exploration timeline was very much on target and it planned on “ramping up activities” in the second quarter on multiple fronts.

The company plans to kick-start mining at its 20% joint venture with Superior Gold Inc. (TSX-V:SGI)(Superior Gold Inc. (TSX-V:SGI)) at the Hermes South deposit, which will offer production revenue to be used to ramp-up exploration spending.

“I think aggressive but targeted exploration is key, and we've got some great brownfields assets like Karonie, which require follow-up from the existing mineralised trends we've already found, as well as a number of greenfield assets like Lake Rebecca which we are waiting to get our teeth into," Wilson told Proactive.

Busy schedule ahead

Alchemy's advanced assets are in strategic locations adjacent to existing producers and along major gold and copper belts.

In WA, in addition to being right next to Silver Lake Resources Ltd (ASX:SLR) (OTCMKTS:SVLKF) (FRA:4SL) at the Karonie project, it has the lion's share of the prospective structure on which it had recent discoveries.

“We don't think that's the main game though, further south, we have the Batavia Project, which has had historic high-grade intercepts such as 3 metres at 14.6 g/t gold, which haven't been followed up since 2012,” Wilson added.

Its Lake Rebecca project, which sits next to the Carosue Dam mine of Saracen, now part of Northern Star Resources Ltd (ASX:ASX:NST), has got tenure covering the highly prospective Keith Kilkenny and Claypan shear zones.

“That’s going to be granted sometime mid-year we hope, and we really look forward to getting on the ground up there.”

It also has a 20% JV on the Hermes South deposit with Superior Gold, giving the company a stake in a 114,000-ounce gold resource which could be mined sometime late this year or early next year.

“That is actual production revenue, which will build our cash balance and allow us to ramp up exploration spending," the CEO said.

“We also have a 20% joint venture with Sandfire (Sandfire Resources Ltd - ASX:SFR) over the Bryah tenements along strike from DeGrussa, which are free-carried to production."

In New South Wales, the company has copper-gold porphyry assets, including large-scale Cadia look-like targets at Yellow Mountain with solid broad intercepts while at Overflow, it has high-grade gold/copper/zinc, including intercepts such as 7 metres at 6.7 g/t gold, 1.0% zinc and 0.3% copper with a strike extent of mineralisation of roughly 700 metres so far and open at depth and along strike.

“So there's a lot to explore, and a lot of value upside for investors,” Wilson added.

New CEO

James Wilson joined the company on January 1, 2021. He is a geologist with more than 15 years of hands-on experience in exploration and operational roles both in Australia, Africa and China, covering a wide range of resources including gold, copper, nickel and uranium.

He has spent the past 14 years working as a metals and mining analyst, with the last five of those years as senior research analyst - resources for Argonaut Securities.

Wilson has joined the Alchemy team at an exciting junction, with exploration programs having been recently completed at the Karonie Project in Western Australia and Overflow Project in the Cobar Basin in NSW, and with several high-quality targets to be tested early in 2021.

Karonie Project

Karonie, 100 kilometres east of Kalgoorlie, is the company’s near-term objective after it had success last year at the Parmelia prospect with 26 metres at 1.6 g/t gold and at KZ5 with 20 metres at 1.3 g/t gold.

Both deposits extend all the way to surface and are open at depth and along strike.

And most importantly, they are both within close proximity to Silver Lake's Aldiss Mining Centre, which is right next door and represent very real, near-term open pit opportunities.

The Karonie Project, comprises 15 exploration licences (including four licence applications) covering over 1,142 square kilometres of highly prospective Archaean greenstones.

It also includes a 38-kilometre-long section of the Claypan Shear Zone directly along strike from Breaker Resources NL’s (ASX:BRB) (FRA:1X2) Bombora gold deposit, which contains a resource of 23.2 million tonnes at 1.3 g/t gold for 1 million ounces.

Alchemy is focusing near-term exploration efforts towards the discovery of additional high-grade gold mineralisation associated with this structure, and other mineralised structures in the district.

So far, only four lines of rotary air blast drilling have been completed.

“We expect to get on the ground with more mapping and structural work near term, and hopefully drilling mid-year,” Wilson added.

Bryah Basin Project

Alchemy’s Bryah Basin Project comprises a 488 square kilometres ground package, 130 kilometres northeast of Meekatharra, in the highly prospective Bryah Basin region.

It is just 30 kilometres along strike to the southwest of leading Australian base metal producer Sandfire Resources’ high-grade DeGrussa and Monty copper-gold deposits, and adjacent to Peak Hill where about 1 million ounces of gold has been mined from several deposits.

Alchemy retains a 10-20% interest in the base metal and gold prospective Bryah Basin Project through farm-in and joint venture agreements with Sandfire and Billabong Gold Pty Ltd.

The company also retains a 1% net smelter royalty (NSR) over 20,000 ounces of gold recovered from the Hermes Deposit (4.7 million tonnes at 2.0 g/t for 303,000 ounces gold) once production reaches 70,000 ounces.

Lake Rebecca Project

Lake Rebecca is still under application - and it's perhaps the most exciting area due to its proximity to the 4.6 million ounces Carosue Dam operations and Apollo Consolidated Ltd’s (ASX:AOP) 1 million ounces Rebecca Project.

“We hope to hit the ground running here with soil geochemistry and mapping as soon as we get the requisite permits to get going and drilling a bit later in the year,” said Wilson.

It has tenure covering the highly prospective Keith Kilkenny and Claypan shear zones, which is expected to be granted sometime mid-year.

Cobar Basin & Lachlan Fold Belt

Alchemy has recently earned an 80% interest in eight NSW licences that are subject to a farm-in and joint venture agreement with Heron Resources Ltd (ASX:HRR).

The licences cover 1,055 square kilometres of the highly prospective, under-explored, Cobar Basin and the Lachlan Fold Belt, and include the Overflow Gold-Base Metal Project, Eurow Copper-Gold Project, Girilambone Copper Project and the West Lynn and Woodsreef Nickel-Cobalt Projects, each containing multiple gold and/or base metal and/or nickel-cobalt targets, including drill-ready targets at Overflow, Yellow Mountain and West Lynn.

Yellow Mountain Project

The geological consultant’s report recommends a combination of deeper diamond drilling at Yellow Mountain, and broad spaced aircore drilling and detailed gravity over the Melrose anomaly.

These recommendations will be integrated into Alchemy’s NSW exploration strategy, which is expected to commence in early 2021.

At Yellow Mountain, the company is looking at deep diamond drilling to test the strong untested IP chargeability high, which could represent potential disseminated sulphides within a VMS feeder zone.

Overflow

Alchemy hopes to be back on the ground at Overflow as soon as possible.

Describing it as “an exciting asset”, Wilson said the last diamond drill program showed that mineralisation remained open down plunge and at depth.

The system is about 700 metres in total strike length so far with high grades.

Drilling confirmed the extent and significance of the Overflow shear zone, whilst highlighting the complexity of structural controls on high-grade shoots at the prospect.

Detailed re-logging of both Alchemy and other historic drill core is planned to determine the structural controls and identify additional drill targets at depth and along strike to the north and south.

Melrose Project

At Melrose, the company is targeting a Cadia lookalike within a 12-kilometre-long alteration zone with a circular magnetic feature within the large Fountaindale intrusive.

There has been no drilling greater than 100 metres deep within the intrusive, despite having gold and low-level copper results historically.

Base metals exploration

Sandfire Resources has earned an 80% interest in Alchemy’s 100%-owned tenements and a 70% interest in the tenements jointly owned by Alchemy and Jackson Minerals Pty Ltd, a wholly-owned subsidiary of Fe Ltd (ASX:FEL).

Alchemy remains free-carried on further exploration to completion of a pre-feasibility study (PFS) and then carried on an interest-free deferred basis for a further $5 million of PFS expenditure, with the deferred amount to be repaid from 50% of Alchemy’s share of free cash flow earned through production.

Heritage surveys and drill rig access clearing for the proposed aircore drilling within the Fiddler and Bulgullan licences were completed in the six months to December 2020.

The drilling will target copper-gold mineralisation within the Narracoota volcanics and the Ravelstone Formation sediments to the south of the Horseshoe Lights copper mine.

A total of 115 aircore holes were completed during the half-year, with a further 250 holes within the Bulgullan Bore prospect area likely to commence in 2021.

A program of Moving Loop Electromagnetics (MLEM), which commenced at Bulgullan Bore during the half will continue into the next reporting period.

Gold exploration

Exploration of Alchemy’s tenements that cover the gold prospective part of the Bryah Basin Project continued under a farm-in and joint venture arrangement with Billabong Gold Pty Ltd, a subsidiary of Superior Gold, with Billabong now having earned a 70-80% interest.

Under the terms of the JV, Alchemy’s interest is carried on an interest-free deferred basis to production, with Alchemy to repay the deferred amount from 50% of its share of free cash flow from production following the commencement of mining.

The Billabong Gold JV includes the Hermes South inferred resource estimate of 2.2 million tonnes at 1.6 g/t for 114,000 ounces gold (0.6 g/t gold lower cut-off).

The mineralisation remains open at depth and has excellent potential for further drilling to expand the area of gold mineralisation and add to the known resource.

Alchemy is confident the Hermes South deposit will become part of the production profile for the Plutonic Gold Operation, with design and scheduling work for Hermes South continuing and mining expected to begin in the first half of 2021.

Detailed work is ongoing to optimise several potential open pit sources, including the Hermes and Hermes South Pits, and to finalise resources and scheduling.

It is expected that heritage surveys and permitting will be undertaken on the Hermes South deposit in the first half of 2021 as Superior Gold looks to include this deposit in its pipeline of near-term development activities.

Read more on Proactive Investors AU