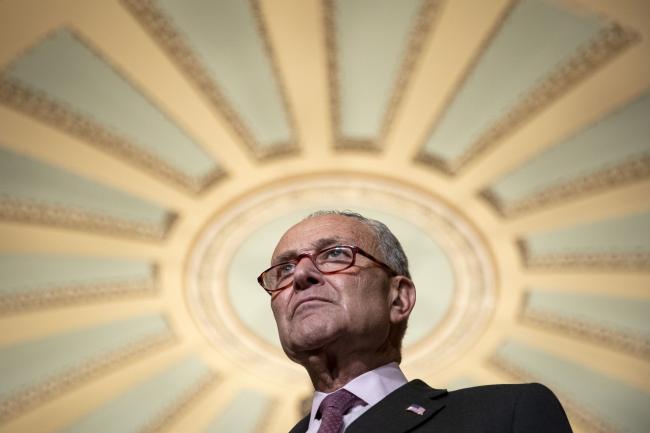

(Bloomberg) -- Senate Democratic Leader Chuck Schumer ratcheted up pressure on Republicans in their feud over raising the national debt limit, announcing Thursday he will seek a vote “as early as next week” on House-passed legislation suspending the legal ceiling.

The timetable brings the vote nearer the Oct. 18 deadline to avoid the first-ever default on U.S. sovereign debt and tightens the time available to pursue a convoluted alternative strategy to overcome a Republican blockade on addressing the debt limit.

Senate Republicans have twice blocked debt ceiling measures from advancing in the 50-50 chamber, where 60 votes are needed to proceed on most legislation.

Schumer again called on Republicans to give consent to let Democrats clear it with just 51 votes, instead of using a filibuster.

“If they want to oppose this measure and bring us closer to financial disaster, they can write their names in the history books as the senator that would let the country default for the first time ever, but Republicans need to get out of the way so Senate Democrats can address this issue quickly and without endangering the stability of our economy,” he said.

Senate Minority Leader Mitch McConnell made clear Republicans remain united behind their demand that Democrats act on their own through a budgetary process called reconciliation, which could take nearly two weeks to complete.

The debt ceiling was suspended for two years under the Trump administration and snapped back into place in August. Although much of the recent increase in federal debt occurred when Republicans controlled the White House and Congress, the GOP is tying the debt limit increase to Democratic efforts to pass a tax and spending package of as much as $3.5 trillion.

The House-passed legislation would suspend the federal debt limit through December 2022.

Treasury Secretary Janet Yellen said earlier this week the government would exhaust the “extraordinary measures” it has been using to pay bills since August and run out of cash on Oct. 18 without congressional action.

©2021 Bloomberg L.P.