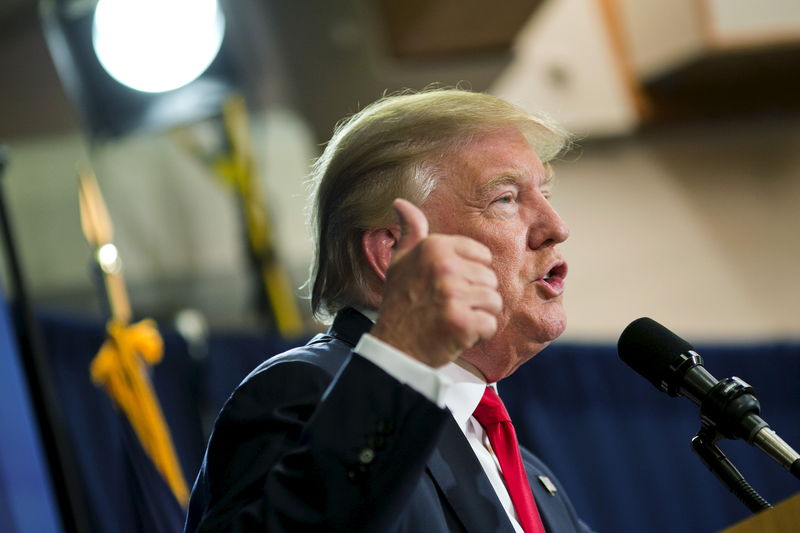

Investing.com -- Former President Donald Trump is unlikely to secure a majority in the Senate sufficient to implement key controversial initiatives, including politicizing the Federal Reserve, Piper Sandler strategists noted Wednesday.

Despite expectations that the Republican party may pick up additional Senate seats, particularly if Trump wins the 2024 election, a clear pro-Trump majority in the Senate is not on the horizon.

The strategists outline several scenarios in their analysis of Senate races, acknowledging the possibility of a Republican majority but noting that this would not be enough to confirm "highly controversial nominees, politicize the Fed, or pass another big tax cut."

Even with potential Republican gains, the presence of moderate and anti-Trump Republicans in the Senate will likely serve as a barrier to any efforts aimed at reshaping the Fed in a more partisan direction.

According to Piper Sandler, next year there will be three key Senate Republicans who have not endorsed Trump, including Lisa Murkowski (Alaska), Susan Collins (Maine), and John Curtis (Utah), the latter likely replacing Mitt Romney, who has been a prominent Trump critic.

The firm also mentions Senators Bill Cassidy (Louisiana), Todd Young (Indiana), and Thom Tillis (North Carolina) as figures who are “to put it mildly, not fans of Trump either.”

“There will be a key bloc of Trump skeptics in the Senate, and they will be especially important when it comes to controversial nominations or potential norm-breaking (including politicizing the Fed),” strategists explained.

This group, they add, is likely to be resistant to any significant new tax cuts, along with several budget-focused lawmakers.

Trump's recent proposal to reinstate the SALT deduction brings his total tax cut plan, including the extension of the TCJA, to an estimated $3 to $4 trillion, though details on the corporate tax rate cut remain unclear.

While Trump’s promises might make it easier to extend the existing tax cuts, the chances of passing a substantial new tax cut are considered slim by the strategists.