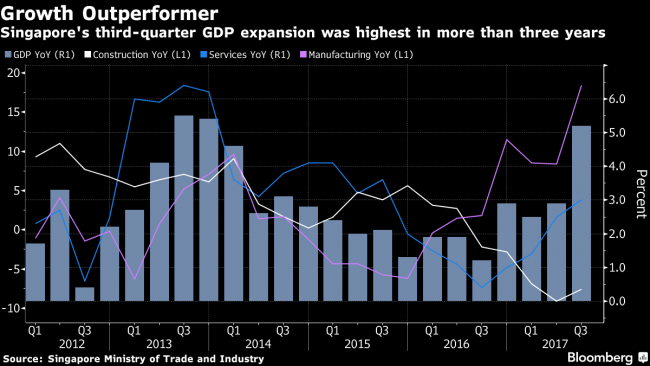

(Bloomberg) -- Singapore raised its economic growth forecast for this year to 3 percent to 3.5 percent after third-quarter data beat projections on the back of stronger exports and manufacturing.

| Highlights of GDP Report |

|---|

|

A healing in global trade this year has helped boost export-reliant economies like Singapore’s, with manufacturing buoyed by demand for electronics goods. Growth has started to broaden out to other industries, such as services, giving economists and the government reason to upgrade their full-year projections. Prime Minister Lee Hsien Loong said earlier this week that growth could exceed 3 percent in 2017.

The trade ministry said on Thursday global growth is expected to improve next year, on the back of a pick-up in the U.S. and some emerging markets.

“We also see signs that the recovery is broadening,” with business services and retail looking better even though third-quarter growth was “primarily supported by manufacturing,” Loh Khum Yean, permanent secretary at the trade ministry, told reporters.

Manufacturing surged almost 35 percent in the third quarter from the previous three months, while the services industry, which makes up about two-thirds of economy, grew an annualized 3.2 percent. Construction continued to suffer, contracting for a third quarter by 5.3 percent.

Southeast Asia Boom

Growth has been surprisingly strong across Southeast Asia, with third-quarter data from the Philippines and Malaysia last week and Thailand this week exceeding forecasts, providing a more upbeat tone to the region as the U.S. Federal Reserve tightens monetary policy.

Jacqueline Loh, deputy managing director at Singapore’s central bank, told reporters the monetary policy stance from October remains appropriate and the regulator will continue to monitor developments. The Monetary Authority of Singapore left its policy stance unchanged last month, but gave itself room to tighten if necessary.

In a separate report, International Enterprise Singapore forecast export growth of 6.5-7 percent for this year, compared with a previous estimate of 5-6 percent, and estimated 0-2 percent expansion next year.

“The pace of growth of the Singapore economy is expected to moderate in 2018 as compared to 2017, but remain firm,” the trade ministry said.