(Bloomberg) -- There may be no respite for the pound after its worst weekly performance in a year.

Sterling fell almost 3 percent last week, after a chaotic Conservative party conference cast the premiership of Theresa May in doubt. With political intrigue set to continue, the Brexit talks restarting and manufacturing data due, strategists anticipate another volatile week and investors in the options market have turned bearish. Meanwhile, May could be planning an overhaul of her team of top ministers soon, the Sunday Times reported.

"Theresa May’s position as prime minister is clearly foremost in the market’s mind,” said Jane Foley, Rabobank’s head of currency strategy. "If she goes, investors are going to be fearful that’s going to open up a catalog of events which will lead to a Labour government.”

On Friday, Theresa May told reporters that she had the "full support” of her cabinet. Although ex-Tory party chairman Grant Shapps said 30 members of the party were willing to sign a letter calling for her to resign, this falls short of the 48 signatures needed to launch a leadership challenge.

May will reshuffle her cabinet after an Oct. 19-20 summit in Brussels, the Sunday Times reported, citing unidentified party sources.

Sterling will "recover its latest Tory-related losses should May cling on and domestic political risks meaningfully ease,” said Viraj Patel, a currency strategist at ING Groep (AS:INGA) NV.

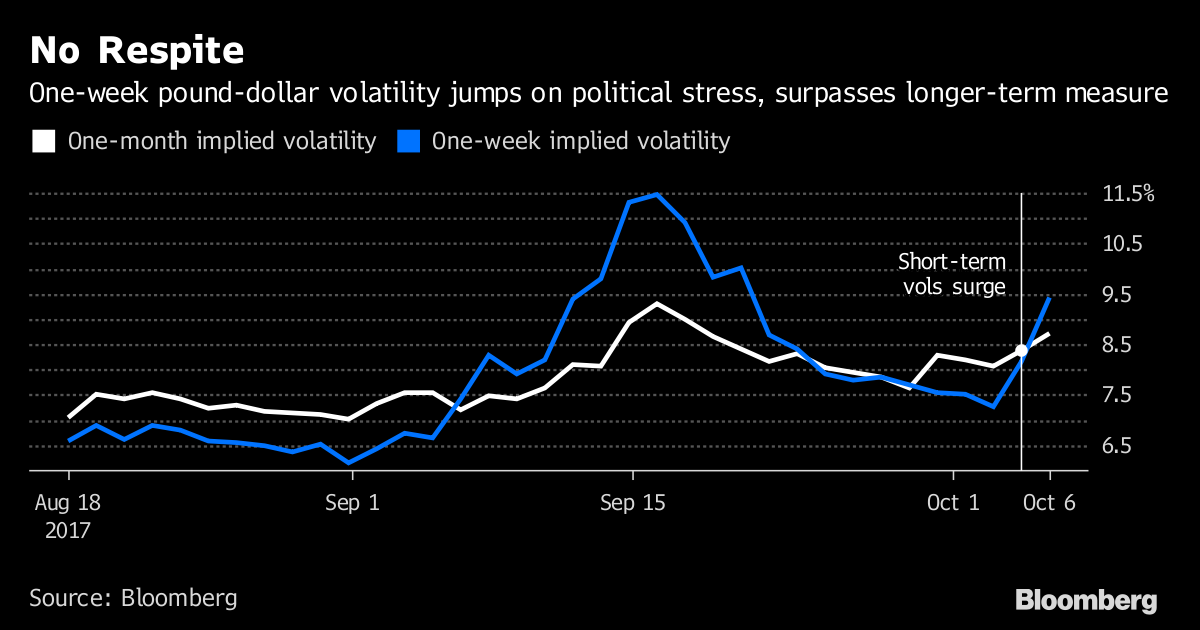

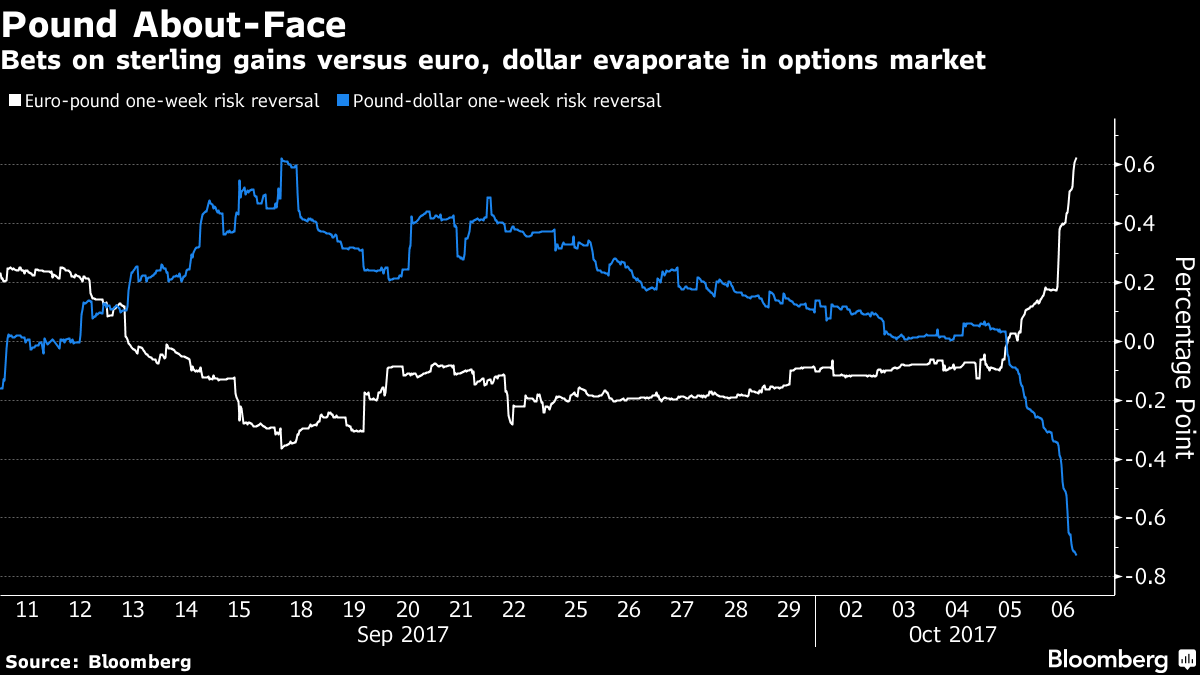

With Brexit talks due to start again this week, one-week volatility on the pound is higher than one- and three-month gauges. That suggests investors see more dramatic moves for sterling in the near term. Meanwhile, one-week risk reversals have turned bearish on the currency.

The market will also be awaiting any further clarity on the Bank of England’s thinking, having priced in an interest-rate hike in November. This week’s data will provide investors with the latest evidence of both how likely the bank is to tighten policy and whether it would be right to do so, said Foley, with industrial production and house prices key.

"We’ve had a number of warnings in the past that a rate hike was very possible only to see no action,” said Standard Bank’s head of currency strategy Steven Barrow. "Another episode of this in coming months might not just set the pound back but could also limit the extent that sterling can rise whenever the bank makes similar warnings in the future.”