Investing.com - Politics are expected to overshadow market fundamentals in the week ahead, with most of the focus falling on Tuesday's U.S. Presidential Election.

Meanwhile, market participants will eye fresh weekly information on U.S. stockpiles of crude and refined products on Wednesday to gauge the strength of demand in the world’s largest oil consumer.

Elsewhere, China is to release what will be closely watched trade and inflation data amid ongoing concerns over the health of the world's second biggest economy.

In the U.K., traders will be awaiting a report on manufacturing production for further indications on the continued effect that the Brexit decision is having on the economy.

Outside the G7, traders will be awaiting a monetary policy announcement from the Reserve Bank of New Zealand on Wednesday.

Ahead of the coming week, Investing.com has compiled a list of the five biggest events on the economic calendar that are most likely to affect the markets.

1. U.S. Presidential Election

The highly-anticipated U.S. Presidential Election will be held on Tuesday. The Congressional Elections for the Senate and the House of Representatives will also be held on the same day.

The first exit polls, which are a projection, are expected to come out on Tuesday night at around 7:00PM ET (00:00 GMT on Wednesday). Results will be declared state by state. If the outcome is clear, the television networks are expected to make their official call at 11:00PM ET (04:00 GMT Wednesday).

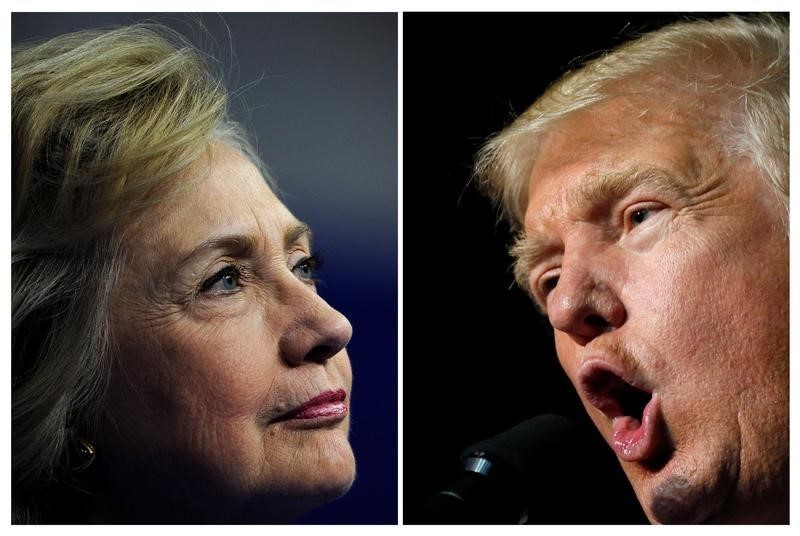

Global financial markets were rattled last week by signs the U.S. presidential election race between Democrat candidate Hillary Clinton and Republican nominee Donald Trump was tightening.

Opinion polls overall still give Clinton the edge in national terms, but an overall narrowing of polls and a tightening race has disrupted market confidence.

Many investors have long been betting on a victory for Clinton, but last week’s announcement that the FBI was renewing its investigation into her use of an unauthorized email server while Secretary of State cast fresh uncertainty onto the race.

Market players have tended to see Clinton as the candidate of the status quo, while there is greater uncertainty over what a Trump victory might mean for U.S. foreign policy, international trade deals and the domestic economy.

2. U.S. EIA Weekly Oil Supply Report

The U.S. Energy Information Administration will release its closely-watched weekly report on oil supplies for the week ended November 4 at 10:30AM ET (15:30 GMT) Wednesday.

Ahead of the official government report, the American Petroleum Institute, an industry group, will produce weekly data on oil supplies at 5:30PM ET (22:30GMT) on Tuesday.

Last week, the EIA reported that U.S. crude stockpiles increased by a whopping 14.4 million barrels, the most since records began, sending oil prices tumbling to five-week lows.

3. China October Trade Data

China is to release October trade figures at around 02:00GMT on Tuesday (9:00PM ET Wednesday). The report is expected to show that the country’s trade surplus widened to $51.7 billion last month from $42.0 billion in September.

Exports are forecast to have dropped 6.0% in October from a year earlier, following a decline of 10.0% a month ago, while imports are expected to fall 1.0%, after decreasing 1.9% in September.

Additionally, on Wednesday, the Asian nation will publish data on October consumer and producer price inflation. The reports are expected to show that consumer prices rose 2.1% last month, while producer prices are forecast to increase by 0.8%.

4. September U.K. Manufacturing Production

The Office for National Statistics is to produce data on U.K. manufacturing production for September at 09:30GMT (4:30AM ET) on Tuesday, amid expectations for a gain of 0.4%. Industrial output is forecast to inch up 0.1%.

The Bank of England held interest rates at a record-low 0.25% last week, as was widely expected, but hinted it could raise rates in the coming months if inflation accelerates too quickly.

5. Reserve Bank of New Zealand Rate Review

The Reserve Bank of New Zealand’s monetary policy update is due at 20:00GMT (3:00PM ET) on Wednesday. Most market analysts expect the central bank to cut its benchmark interest rate by 25 basis points to a record-low 1.75% to help meet inflation forecasts.

RBNZ Governor Wheeler will also hold a press conference following the decision.

Stay up-to-date on all of this week's economic events by visiting: http://www.investing.com/economic-calendar/