By Geoffrey Smith

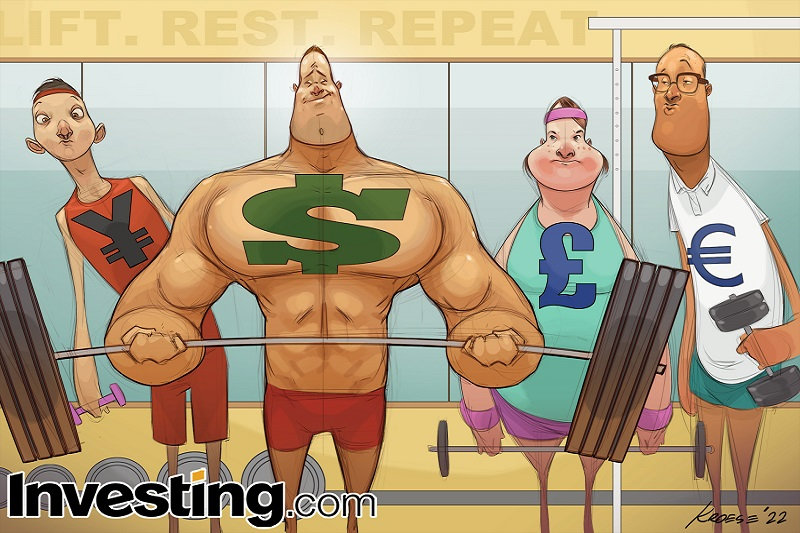

Investing.com -- Central bankers may not want to see it this way, but this week’s round of policy meetings is boiling down to a brute test of strength.

Whose economy is strong enough to withstand the battering of big interest rate rises as the world’s monetary guardians try to tame the beast of inflation? It looks like being a short list.

Another upside surprise to U.S. inflation in August has prompted speculation that the Federal Reserve will raise the target range for fed funds by a full percentage point on Wednesday, even though the headline rate fell to 8.3%.

A year ago, such an aggressive move, the biggest rate hike in nearly 30 years, would have been unthinkable. But inflation has been so sharp and – increasingly – so broad that few would argue with the Fed if it does go the full 100 basis points.

Indeed, most analysts are now arguing that the key issue from the meeting, and from Chair Jerome Powell’s subsequent press conference, will not be ’75 or 100,’ but rather what the infamous ‘dot plot’ – which shows where the Fed’s top brass expect rates to be over the next two years – has to say about how high rates will have to go and how long they will have to stay there in order to bring inflation down.

Short-term dollar rate futures currently imply that the fed funds rate will top out between 4.25% and 4.50% by April next year. That will require the Fed to hike by 2 full percentage points over the next six months, which means that 100 basis points on Wednesday will already get half the job done. It follows that the pace of tightening slows down considerably thereafter.

This pattern of ‘’front-loading” rate hikes was already evident in the first major central bank meeting of the week earlier on Tuesday, where Sweden’s Riksbank jacked up its policy rate by 100 basis points – more than widely expected – to 1.75%.

However, the Riksbank’s own guidance for the future path of rates indicated that it only expects to raise by another 75 basis points before starting to cut in 2024, Gustav Helgesson, an economist with Nordea, said in a note to clients.

“By raising the policy rate more now, the risk of high inflation in the longer term is reduced, and thereby the need for greater monetary policy tightening further ahead,” the Riksbank said in its statement.

Admittedly, the Riksbank – like many central banks over recent years – has been notoriously inaccurate with its forecasts. But the argument of a sharp hike now to avoid more tightening later is likely to repeat itself throughout the week, especially on Thursday, when the Bank of England will hold its Monetary Policy Committee meeting.

Sterling has suffered in recent weeks as markets have lost faith in the BoE’s ability to match the Fed step for step, even though the U.K.’s inflation rate – at over 10% and still headed higher in August – is considerably worse than the U.S.’s. Analysts expect the BoE to raise by only 50 basis points, but the U.K. economy is in such poor shape that any guidance that talks of further rate hikes will be received with skepticism.

But by the time the BoE meets, the foreign exchange market may have more important things to worry about. The Bank of Japan – the last and greatest inflation dove in the central banking community – will also meet on Thursday, at a time when the Japanese government is showing increasing signs of alarm at the yen’s depreciation.

The yen is down 20% against the dollar in the last seven months alone, a decline that goes well beyond the benign depreciation that used to be welcomed as a prop to exports.

The Bank of Japan was reported last week to be “checking rates” with FX traders, historically a prelude to intervention. But despite this, there still seems to be little appetite at the BoJ to loosen its policy of depressing bond yields.

Norway and Switzerland will also be rolling out rate decisions on Thursday. But arguably of more interest will be the meetings in emerging markets.

Brazil, which started its hiking cycle early, is not expected to tighten further. Nor is Turkey, which appears to have deliberately chosen a path of currency debasement. But in South Africa and Egypt, rates are set to go up by 75 and 100 basis points, respectively - measures that will likely have a big impact on their respective economies.

BNP Paribas (OTC:BNPQY) chief economist William de Vijlder says global central banks are in the second stage of a three-stage tightening cycle. After an initial stage of panic at being ‘behind the curve,’ they have now progressed to a stage of ‘perseverance’ with rate hikes that they know will be painful, but necessary. After this, finally, comes ‘patience,’ as they wait for the tightening of policy to take effect.

“Frontloaded tightening,” de Vijlder wrote in a note to clients this week, “should lead to a lasting reduction in the risk of inflation expectations spinning out of control.”

In the near term, “the aggressiveness of this approach leads to mounting concern about a hard landing, but during this perseverance phase, this does not stop central banks from pushing the brakes ever harder.”