By Geoffrey Smith

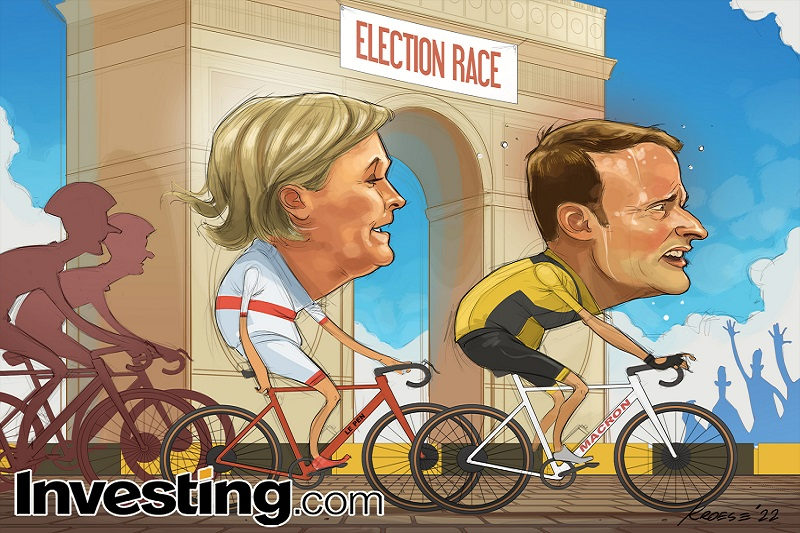

Investing.com -- In the political Tour de France of 2022, Emmanuel Macron has won an important stage victory.

The Fifth Republic’s youngest ever president is now odds-on to become the first president to win re-election since Jacques Chirac 20 years ago.

That matters. With war having returned to Europe, France and the EU are at a crossroads. Driven by a liberal, internationalist outlook, Macron has sided solidly with Ukraine, pushing Europe for harder sanctions than it is currently prepared to countenance. It is inconceivable that France under Marine Le Pen – an avowed admirer and kindred spirit of Vladimir Putin, who approved of his annexation of Crimea eight years ago - would behave the same way.

Irrespective of the rape of Ukraine, it matters a lot to Europe who rules France for the next five years. Macron has pushed through important reforms in his first term and while the pandemic may have wrecked his attempts to end France’s chronic budget deficits, it has not stopped him bringing the unemployment rate – France’s perennial Achilles’ heel - down from 9.5% at the start of his term to only 7.4% now. Youth unemployment has fallen to 16% from over 24% in the same timeframe.

Not that he has had much credit for it. Indeed, every age group under 60 preferred Le Pen to Macron in Sunday’s poll. And nearly three-quarters of voters in Sunday’s first round cast their vote for rupture with the liberal establishment world view and world order that Macron represents.

It’s enough to make one think that the degree to which French society consents to be governed is on a permanently downward slope. The traditional parties of right and left have collapsed, collecting less than 7% of the vote. The Green candidate also polled less than 5%. The difference with the continent’s other major power Germany, where mainstream parties last September regained ground lost to extremists since the Great Recession, could hardly be more glaring.

Macron may point to the fact that the 27.8% share of the vote he picked up on Sunday was actually more than the 24.0% he scored at this stage five years ago. But Le Pen can point to similar gains, to 23.4% from 21.3%. Five years ago, Macron beat Le Pen in the run-off by a margin of 66%-34%. Today’s polls suggest he will lose at least 10 points of that. One poll even put Le Pen within the margin of error for overall victory.

Small wonder, then, that Macron is belatedly trying to neutralize the talking points that have driven Le Pen’s campaign. In an interview with BFM TV on Monday, he left open the possibility of a referendum on his plans for pension reform, in whatever final shape it takes. His current proposal – to raise the retirement age to 65 years from 62 - may be soundly enough rooted in economic reality, but it is an easy target for populists who feel no pressure to balance the books.

And the books must be balanced, one way or another. The pandemic has undone almost all the good work of Macron’s reforms. After shrinking to 1.6% of GDP in 2018, France’s structural budget deficit – that part which can’t be argued away by the business cycle – has widened to 7.5% of GDP as Macron, like the head of many other governments across the world, has simply thrown newly-printed money at the problems caused by Covid-19. France’s debt now stands at an estimated 115% of GDP, meaning that a sustained bout of inflation and higher interest rates could easily bring growth – and the associated payroll gains – to a halt.

How Le Pen would deal with such a situation is anyone’s guess. At least on the surface, markets have less reason to be afraid of her winning than five years ago. Grand plans to leave the euro and the European Union have disappeared from her platform (which explains why she has picked up so many votes from the mainstream conservative Republicains). Even so, “with her agenda of protectionism, reform rollbacks, subsidies and harsh measures against immigration, she would likely trigger noisy conflicts within the EU,” said Holger Schmieding, chief economist with Berenberg Bank, in a note to clients.

‘Noisy’ is putting it mildly. Not much in Le Pen’s agenda is compatible with the EU’s budget or antitrust rules. For markets at least, however, given that her party would still need to win control of the Assemblee Nationale in June to enact that agenda – which seems unlikely – the realistic worst-case scenario for markets looks reasonably limited.

Of more concern is that a Le Pen victory would be - quite literally – a death sentence for Ukraine, and an invitation to Russia to continue its imperial adventures in eastern Europe if and when it ever succeeds in digesting its current prey. During the campaign, Le Pen told a television interview unapologetically that she would rather bring gasoline prices down for French drivers than support Ukraine with sanctions on Russia. That kind of talk can buy votes today cheaply enough, but in the long term may cost Europe even more than her dream of ‘Frexit’ would have.