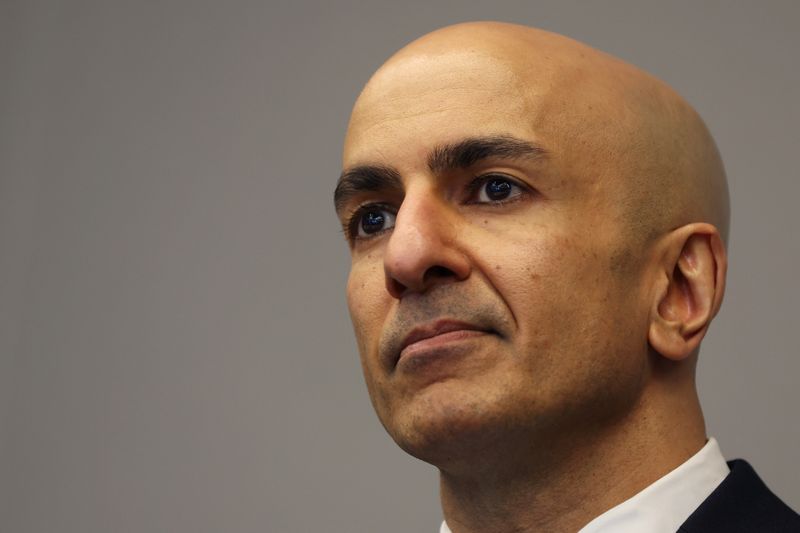

Investing.com -- A upside surprise in inflation in weeks leading up to the Federal Reserve's December meeting, could encourage the central bank to pause rate cuts, Minneapolis Federal Reserve Bank President Neel Kashkari said Tuesday..

"If inflation surprises to upside before December, that might give us pause [on rate cuts]," Kashkari said just a day ahead of fresh inflation data.

Headline consumer inflation is expected to have picked up pace in October, with economists forecasting a pace of 2.6% up from 2.4% a month earlier.

The Minneapolis Fed president pointed to signs of stronger economic productivity suggesting the neutral rate - one that doesn't stimulate nor weigh on economic growth -- could be higher which would keep a lid on the rate-cut cycle.

Kashkari also said that the Fed would be in wait and see mode until there was more insight into President-elect Donald Trump's policy agenda.

Following the Fed's 75 basis points of rate cuts seen since the start of the easing cycle, Kashkari said he thinks the Fed is "modestly restrictive right now," and expects economic growth to persist.

Ultimately, Kashikari continues to beleive that the incoming data would continue to play a leading role on how deep the Fed cuts rates.