(Bloomberg Gadfly) -- This might be the year China gets its first four-letter default. Or so says S&P Global Ratings, discussing the possibility that an LGFV, or local government financing vehicle, could finally go belly-up.

Why should global investors care? More than 95 percent of the $1 trillion asset class is yuan-denominated and trades onshore. The offshore portion is small, and showing little sign of distress. The coupon on a $500 million, three-year dollar bond recently issued by Central Plaza Development Ltd. was 3.875 percent. This LGFV, perceived to be backed by the Municipality of Beijing, paid the same coupon last January for a $400 million offer of similar maturity. If anything, the spread of these bonds over U.S. Treasuries has narrowed.

Not all issuers are as well-loved, however. The 2019 dollar note of Jiangsu NewHeadline Development Group Co. now yields 350 basis points more than comparable government bonds. While the 50-basis-point widening of the spread since November warrants attention, it's still narrower than in April 2017, when NewHeadline -- a provider of construction services to Lianyungang municipality in the eastern province of Jiangsu -- was the first LGFV to get a debt downgrade.

So much for dollar bonds. Things are a lot tighter in the onshore market, though. And this is where S&P's warning may be particularly relevant:

These financing platforms are often able to roll over debt despite poor operating fundamentals, due to expected government support. However, the implicit support by their respective governments will be tested, given the central government's renewed efforts to reduce financial risks of runaway local government debt growth.

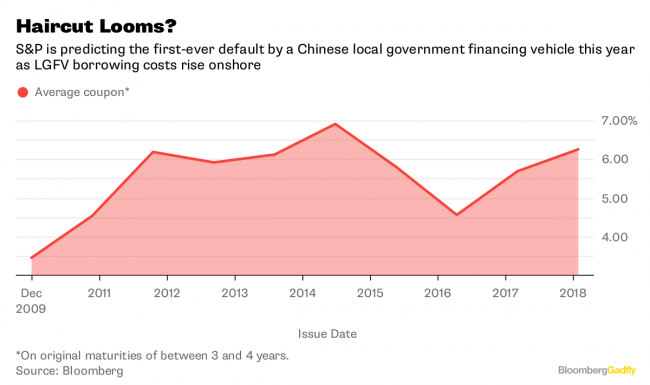

Issuance of yuan-denominated LGFVs fell 21 percent last year, while the average coupon shot up to 5.7 percent on maturities of about 3 years, or 1 percentage point more than in 2016. This year, the cost of borrowing is still rising. At this rate, refinancing could indeed become tricky for some borrowers, and the implicit guarantees by sub-national governments might come into play.

But not all local governments are rich. Some may not be able to backstop all their perceived LGFV liabilities, which have played a major role in making China's infrastructure the world's envy. Even now, they're the main source of investment in major public works, increasing the contingent obligations of regional and local governments, according to Moody's Investors Service.

Yet letting weak LGFVs fail may be an acid test of President Xi Jinping's deleveraging campaign. As long as the failures are few; only hurt domestic creditors; and don't threaten critical urban infrastructure such as subways and utilities, the central government probably will refrain from mounting a rescue. After all, the whole idea behind coaxing regional governments to replace their off-balance-sheet debt with municipal bonds has been to prevent LGFVs from triggering a sovereign-debt crisis.

While investors have known that for some time, so far they have ignored the risk of losing money. Now that they're demanding more compensation, it appears that the first haircut is coming closer.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Andy Mukherjee is a Bloomberg Gadfly columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.