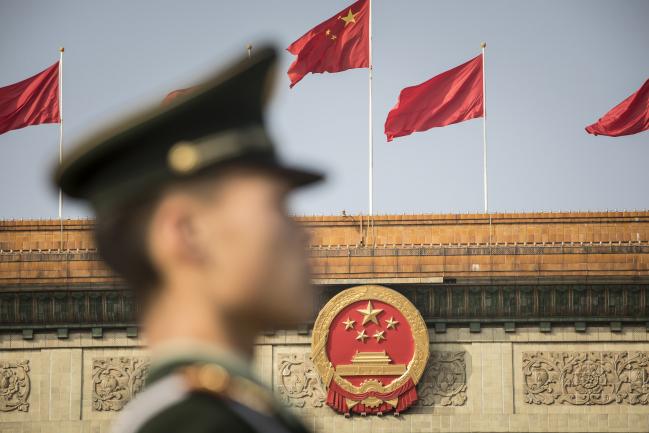

(Bloomberg) -- Chinese President Xi Jinping demonstrated his grip on power Wednesday by unveiling a new leadership line-up that didn’t include a clear potential heir, after concluding a key twice-a-decade Party Congress.

While the message of political consolidation is clear, the economic implications are harder to read. Xi promised further reform when speaking to reporters after introducing the new elite seven-member Politburo Standing Committee. Key pro-market officials were promoted to central positions, but economists diverge on the real extent of likely liberalization.

Here are some economist voices that shed light on where the $11 trillion economy might be heading:

Bloomberg Intelligence analysts led by Tom Orlik see a stronger state:

- "The absence of an obvious heir to General Secretary Xi Jinping -- following his inclusion in the Party constitution -- confirms Xi’s position as the most powerful leader since Deng Xiaoping."

- "It’s possible that with political barriers removed, Xi will speed ahead with ambitious market reforms. Bloomberg Economics’ view though, is that Xi’s economic vision is more focused on a strong state and activist industrial strategy than liberalization. "

Julian Evans-Pritchard at Capital Economics Ltd. sees consolation in the promotion of pro-market officials:

- "There are few signs that Xi plans to use his increased power to resolve China’s key structural problems."

- "The only silver lining is today’s promotion of key officials that favor greater reform, which offers a modicum of hope that policy could shift in a more liberal direction in future as the flaws in Xi’s current agenda become clearer."

- "It remains to be seen to what degree they can help nudge policy in the direction that is desperately needed -- toward less state interference in the economy."

Yanmei Xie at GaveKal Dragonomics announces the "coronation" of President Xi Jinping:

- "China’s Communist Party concluded its conclave with a decisive validation of Xi Jinping’s personal leadership, granting him a status and authority unmatched by any Chinese political figure in recent history, and setting the stage for him to exert that power for many years to come."

- "Xi has already been implementing the economic program he favors -- focused on maintaining a strong state with firm control over any financial or social risks -- and there is no reason to expect a major change of course on the economy."

HSBC Holdings Plc (LON:HSBA). analysts including Julia Wang see a stronger central bank:

- "The formalization of a framework twin pillar" -- monetary policy and macro-prudential regulations -- during the Congress "may give the central bank additional regulatory power in the coming year."

- "Firstly the policy focus on debt sustainability is real, and will play a role in policy deliberations on many fronts. Secondly, the policy approach is reform-oriented and gradualist, and not a monetary shock therapy."

- Green initiatives are now a "key element of economic growth, and have become an increasingly critical consideration in most policy discussions."

Economists at Mizuho Securities Asia Ltd. led by Shen Jianguang forecast more focus on easing inequality:

- "It allows the leadership to turn its focus from solely the pace of China’s economic growth to the quality and sustainability of it."

- "We continue to expect the leadership to become more focused on easing China’s massive income inequality, severe environment pollution, and housing bubble and surging leverage, as well as further deepening of the structural reforms."

Morgan Stanley’s Robin Xing and analysts project that reforms, if implemented, would help China escape the middle-income trap:

- "Policy makers will continue with capacity cuts and leverage control efforts made to date, leading to slower but more self-sustaining growth while reducing risk of a financial shock."

- Omission of a clear growth target and evolving language signal "a shift in focus from production expansion (growth target) to balanced development."

- "No change in policy direction, but execution could be stronger."

To contact Bloomberg News staff for this story: Xiaoqing Pi in Beijing at xpi1@bloomberg.net.

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net, Jeff Kearns

©2017 Bloomberg L.P.