(Bloomberg) -- If he wants, Stephen Poloz can say he has some wiggle room on rates.

How quickly the economy can expand without triggering inflation is one of the key questions Bank of Canada policy makers are asking ahead of Wednesday’s rate decision and monetary policy report. The faster they believe it can run before overheating, something Governor Poloz may indicate this week, the longer he can afford to wait on raising interest rates.

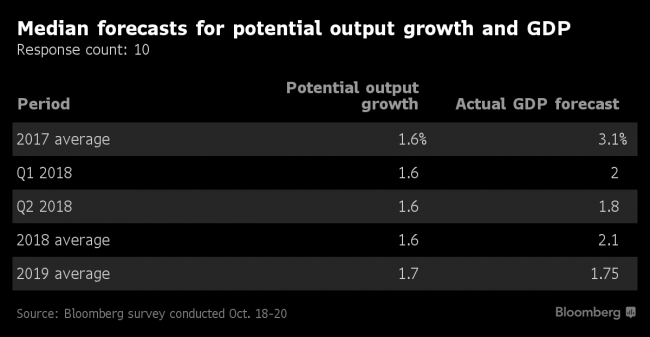

In July, the central bank was assuming the economy’s production capacity, or so-called potential output, would grow at an average pace of 1.4 percent between 2017 and 2019. Economists surveyed by Bloomberg News now anticipate potential growth is closer to 1.7 percent. Canada’s economy this year is actually growing at a 3 percent clip, almost double capacity, and economists project growth of 2 percent over next two years.

A small change to capacity growth could make a difference for monetary policy. The governor only needs potential growth to move up a few tenths of a percentage point to say that supply and demand will be balanced over his two-year forecast horizon, Derek Holt, head of capital markets economics at Bank of Nova Scotia in Toronto, wrote in a research note.

“Poloz continues to prime markets for a likely upward revision to the economy’s non-inflationary speed limit and slightly greater slack estimates,” he said.

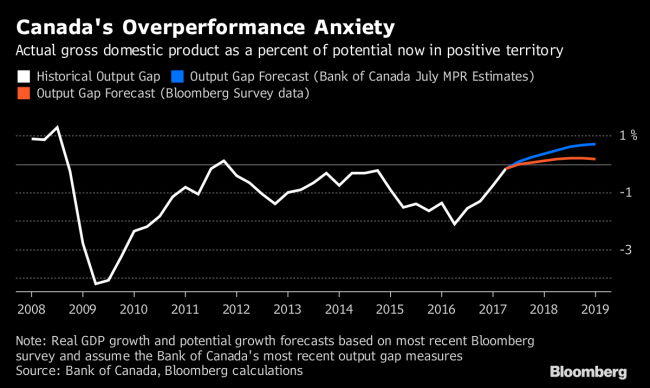

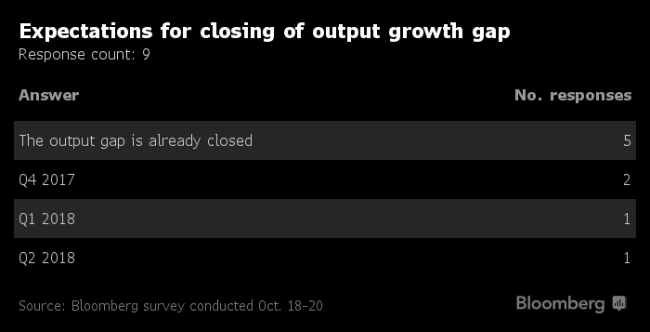

The combination of fast growth with slow potential this year has already eliminated the bulk, if not all, of the remaining spare capacity in the economy, prompting the Bank of Canada to raise interest rates twice this year. Investors see more rate hikes as early as December. In July, the Bank of Canada estimated the output gap -- a measure of excess capacity -- would close by the end of this year.

Half of the 10 economists surveyed by Bloomberg say the output gap is already closed, and two more estimate there will be no excess capacity by the end of the year. That means potential growth needs to keep up with actual growth over the next two years, or else capacity pressures could build in the economy and trigger inflation.

Poloz believes the economy may have more scope to grow. Speaking to reporters this month in Washington, the governor said there are signs investment could become a more important part of the growth story. Such spending not only fuels the expansion, but at the same time grows the economy’s production capacity and potentially helps mitigate inflation, he said.

“You always overestimate inflation at this stage of the cycle” as more companies join an investment rebound, Poloz told reporters at an International Monetary Fund Meeting in Washington, in his last public comments before Wednesday’s rate meeting.

If Poloz embraces the kind of upgrade to potential growth that economists predict, it could shake up the consensus view the next move higher will come in December or January. It would allow Poloz to remain comfortably on hold until he can gauge the impact the previous two rate increases are having on Canada’s economy, and its indebted households, said Brian DePratto at Toronto-Dominion Bank.

Jacking up rates would strain consumers already grappling with a record C$2 trillion in debt. Another concern would be driving up Canada’s dollar just as Donald Trump threatens to kill Nafta, a trade deal that covers three-quarters of Canada’s exports. Plus, there are few signs of inflation to begin with.

“It becomes more of a question of speed around normalization rather than will they or won’t they,” said DePratto, who predicts the next rate increase in December. “It’s not a mechanistic procedure for them, they can move around their estimates there to give them some wiggle room.”

Hold Expected

Wednesday’s rate decision -- widely expected to be a hold -- is due at 10 a.m. in Ottawa. The current rate is 1 percent.

Here are some other signs the economy has more scope to expand.

- Wage gains are running less than half the pace of similar periods in the past two decades when the jobless rate fell below 7 percent. Wage gains average 2.6 percent since 1998, Statistics Canada figures show. That suggests companies have plenty of hiring room before wage inflation ticks up.

- Companies have cash to splash out on expanding production capacity. The average holdings of cash or liquid securities for a group of about 200 publicly traded Canadian companies tops C$400 million, according to a Bloomberg search based on their financial records.

- Poloz has shown enthusiasm for the softer data gathered in the bank’s quarterly Business Outlook Survey of about 100 business leaders, and the latest edition said that while capacity pressures have intensified over the past year, difficulties meeting demand aren’t yet widespread.

In terms of inflation pressures, economists “just aren’t seeing a lot of spark and that’s not just a Canada thing,” said Dawn Desjardins, assistant chief economist at Royal Bank of Canada in Toronto. “That’s what they are trying to tell us -- they’re in no big rush here and maybe the economy has a little more room to run.”