(Bloomberg) -- As Governor Haruhiko Kuroda heads into the Bank of Japan’s policy meeting next week, he has an additional factor to watch out for: politics.

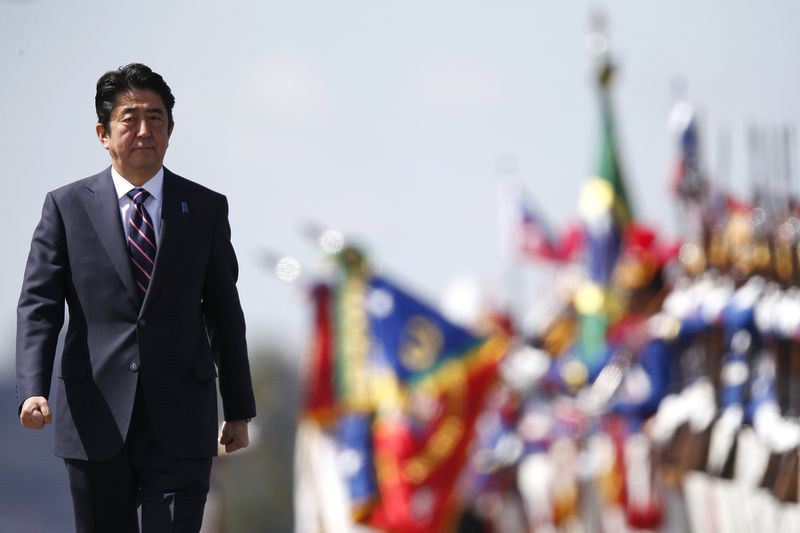

Scandals have cast doubts on Prime Minister Shinzo Abe’s ability to stay as leader of the Liberal Democratic Party, raising questions over the future of Abenomics. That may fuel yen gains, which could derail the inflationary impact of the monetary easing that Kuroda has pursued since being first appointed by Abe in 2013.

Despite sliding in the last three weeks, the yen continues to be this year’s top performer against the dollar in Asia, with an almost 5% gain. It climbed on Monday, as thousands of anti-Abe protesters rallied on the weekend and a Nippon TV survey showed that approval rating for the prime minister fell to a record low of 26.7 percent.

The timing of the scandals -- which range from doctored land-sale documents to an alleged cover-up over the activity of Japanese troops during the Iraq war -- doesn’t help.

Fears over the future of Abenomics are mounting at a time when the BOJ is finally beginning to see the results of five years of its ultra-loose policy stance. Japan’s headline inflation measure is expected to rise to 1.1 percent this year and in 2019, from 0.5 percent in 2017, the IMF said in its World Economic Outlook earlier this week.

The yen also stands to gain as a haven asset from any escalation in global trade tensions. Leveraged funds held a net long yen position of 22,126 contracts as of the week ended April 10, according to Commodity and Futures Trading Commission data.

Technical indicators also suggest that the dollar-yen could see more downside, with resistance around the 108 level continuing to hold. Slow stochastics, a momentum indicator, has ominously turned bearish with a %D reading of 72 and falling as it retreats from overbought territory.

Abe faces a party leadership vote in September, though his former mentor Junichiro Koizumi has predicted that he would step down in June. That may fuel yen gains just as the BOJ’s policy is under increased scrutiny. Kuroda said in March the central bank may think about exiting its monetary stimulus in fiscal 2019, without committing to any firm action.

Below are key Asian economic data and events due next week:

- Monday, April 23: New Zealand credit card spending, Nikkei Japan PMI manufacturing, Singapore CPI, Thailand customs trade balance

- Tuesday, April 24: Australia 1Q CPI, RBA’s Kent speaks in Sydney

- Wednesday, April 25: South Korea consumer confidence

- Thursday, April 26: South Korea 1Q GDP, Singapore industrial production

- Friday, April 27: Australia 1Q PPI, New Zealand trade balance and consumer confidence, BOJ rate decision and Outlook report, Japan jobless rate, retail sales, industrial production and Tokyo CPI, China industrial profits, South Korea business survey manufacturing/ non-manufacturing, Thailand forex reserves