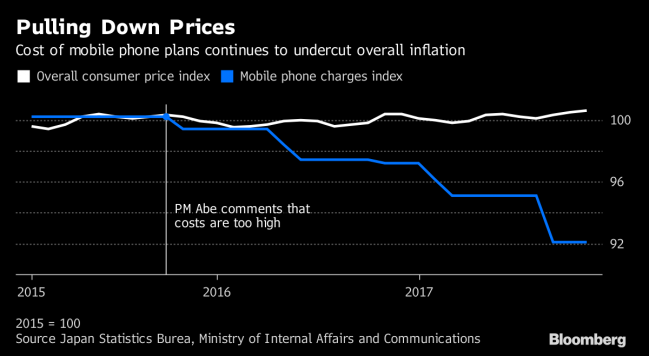

(Bloomberg) -- In 2015 Prime Minister Shinzo Abe said mobile phone contracts were too expensive and called for them to be cut. Since then, prices of phone service contracts have fallen for 25 straight months, on a year-on year basis.

That’s good for consumers but it’s bad for efforts by Bank of Japan Governor Haruhiko Kuroda to generate sustained inflation of 2 percent.

Kuroda said last month that the decline was the biggest reason the BOJ cut its forecast for inflation this fiscal year, although he said the effects were transitory. That’s different from his comments in September 2015, when he said that Abe’s push for lower cell phone fees would help boost real household incomes and that would be positive for achieving 2 percent inflation.

“The drop in mobile phone fees has been a major drag on inflation,” said Takahide Kiuchi, a former BOJ board member who stepped down in July. “This is evidence that the government isn’t prioritizing helping the BOJ achieve the 2 percent inflation target. Ending deflation is fine but the politicians know creating 2 percent inflation hasn’t received wide public support.”

Phone contract costs started dropping in October 2015, the month after Abe asked the government to look at reducing the "big burden" on households by lowering fees. Soon after Abe’s comments, the government set up a task force which pushed to increase competition by raising the number of mobile operators who don’t have their own wireless network infrastructure.

Since Abe spoke, the number of contracts with these independent operators doubled to more than 8 million as of March this year, according to MM Research Institute in Tokyo. Major cell phone carriers also began offering cheaper plans.

Mobile phone charges make up more than 2 percent of the basket of goods used to calculate inflation, and without the drop in fees in September, overall inflation would have been 0.3 percent instead of the 0.2 rise that was reported, according to the statistics bureau.