By Ambar Warrick

Investing.com-- Japanese industrial production was revised even lower in October, data showed on Wednesday, as rising input costs due to elevated inflation and weakening overseas demand weighed heavily on local manufacturing.

Industrial production fell 3.2% in October from the prior month, data from the Ministry of Economy, Trade and Industry showed, more than the prior estimate of negative 2.6%. The reading was also nearly twice as much as September’s decline of 1.7%.

The data also showed shipments shrank further during the month, as did business inventories. Still, data released with the earlier estimate showed that the outlook for manufacturing activity was improving.

Japanese businesses are facing increased input costs due to rising inflation, which has once again dented manufacturing activity this year. Data released earlier on Wednesday showed that factory sentiment in the country weakened further in the fourth quarter, amid worsening trends for the sector.

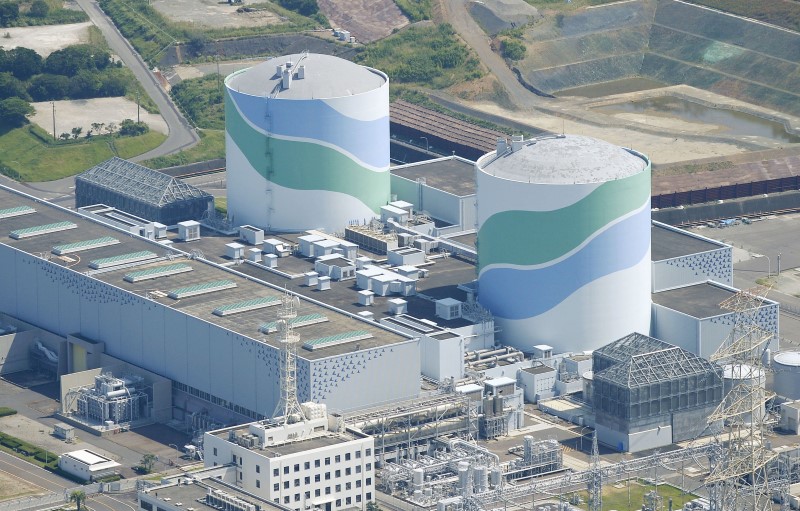

A weakening yen weighed heavily on Japanese producers this year, as it ramped up the cost of importing raw materials. Utilities such as gas and electricity also grew more expensive due to volatility in global commodity prices.

The yen was driven lower largely by a growing rift between local and U.S. interest rates, given that the Bank of Japan has maintained its ultra-accommodative monetary policy for nearly eight years.

But this trend may change in the coming months, especially with U.S. inflation easing further from a 40-year peak hit earlier in 2022. Easing price pressures could necessitate smaller rate hikes by the Federal Reserve, reducing the pressure from a stronger dollar on the yen.

Commodity markets also appear to be stabilizing, which could further benefit Japan’s trade balance.

Data due later this week is expected to shed more light on Japan’s foreign trade, which has been in dire straits due to a weakening yen and sluggish overseas demand for goods.