By Brijesh Patel

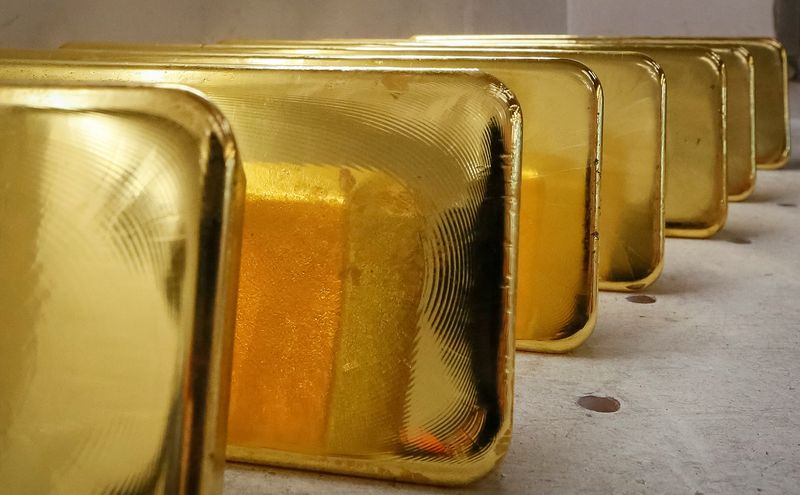

(Reuters) - Gold on Tuesday extended its blistering rally towards an all-time high as investors made a beeline for the traditional safe haven on mounting fears about the Ukraine crisis and the impact of a possible ban on Russian oil by the United States and Britain.

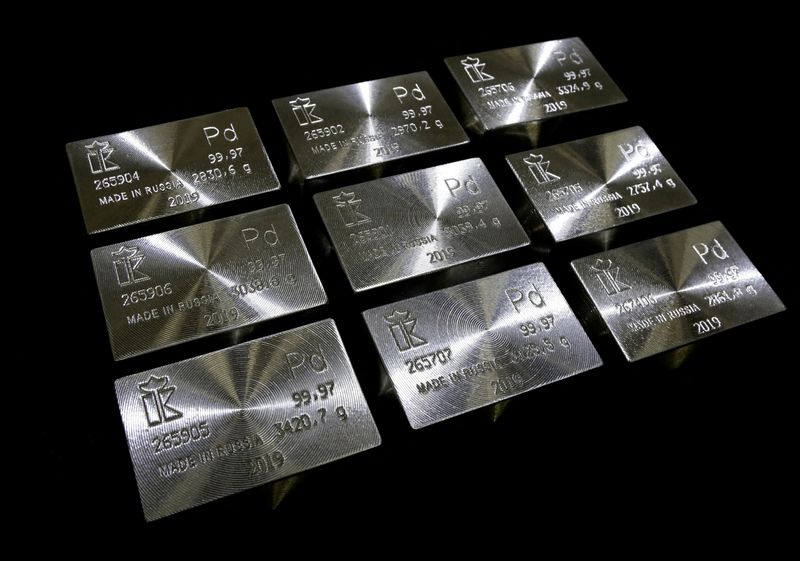

Meanwhile, worries over a palladium supply shortfall due to sanctions on Russia, the top producer of the auto-catalyst metal, kept its price near all-time highs.

Spot gold was up 3.3% to $2,062.91 per ounce as of 10:45 a.m. EST (1545 GMT), about $10 away from a peak of $2,072.50 touched in August 2020.

U.S. gold futures climbed 3.6% to $2,068.30.

"The combination of roaring energy prices, grain prices, base metal prices is culminated in dramatic inflationary pressures that continue to be the major underlying support behind gold moves higher," said David Meger, director of metals trading at High Ridge Futures.

"In addition, we're seeing significant amount of safe-haven bids in the gold market as equity markets have come under pressure due to major concerns on the geopolitical front."

Soaring oil prices and the Ukraine war have slammed appetite for riskier assets. [.N] [MKTS/GLOB]

U.S. President Joe Biden was expected to announce a ban on Russian oil on Tuesday. Britain will also ban Russian oil imports, Politico reported, citing government officials.

Bullion, which has risen nearly 13% this year, is considered a safe store of value during times of geopolitical uncertainty and rising inflation.

Palladium rose 3.1% to $3,088.89 per ounce after hitting an all-time high of $3,440.76 on Monday. It has risen over 60% this year.

In the event of shortages, car manufacturers would be willing to pay almost any price for the metal to keep up production, Saxo Bank analyst Ole Hansen said.

The market took note of the London Platinum and Palladium Market's statement that Russian refiners can continue to sell platinum and palladium in London.

Platinum jumped 4.8% to $1,176.78 per ounce, while silver rose 4.5% to $26.82.