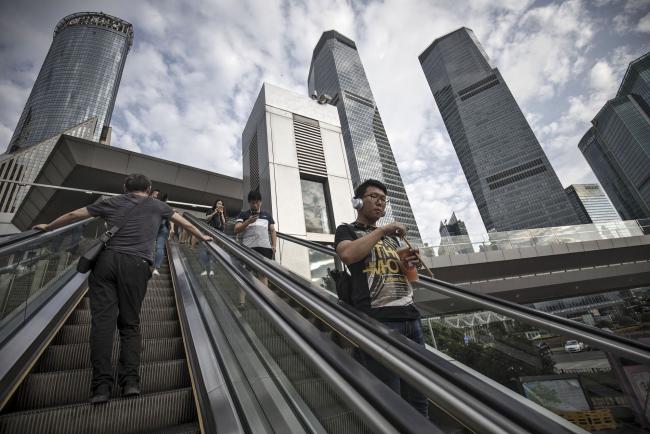

(Bloomberg) -- The continued growth of China’s finance sector and the strong expansion of IT helped soften the economic slowdown in the second quarter and offset a muted performance from the manufacturing and tertiary sectors.

Output from finance increased 7.6% from a year earlier, a step higher from the previous three-month period, the statistics bureau said Tuesday. Information technology growth slowed to 20.1%, the lowest in two years but still well above the 6.2% expansion in overall gross domestic product.

The sector breakdowns were released in a report on Tuesday, following the announcement of the main data on Monday. Overall GDP slowed slightly from the first quarter, but the data also showed a surprisingly strong expansion in retail sales and industrial output in June.

Services, which makes up more than half of output, maintained steady 7% growth, while primary industry expanded 3.3% and secondary industry, which contains manufacturing and construction, slowed to 5.6%.