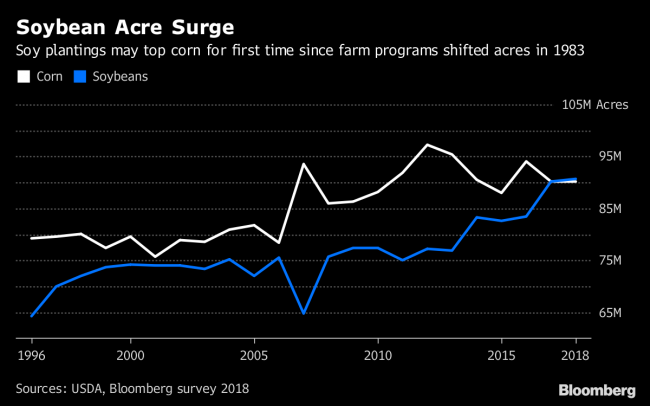

(Bloomberg) -- For the first time in 35 years, soybeans are poised to steal the crown of U.S. crop king from corn.

American farmers are set to increase their soy plantings to a record 90.69 million acres, according to the average estimate in a Bloomberg survey of 21 trading firms and analysts. Corn sowings are forecast to drop to 90.12 million. The last time soy surpassed corn was 1983, when government payments were based on idling acres.

For the full survey results, click here.

If it feels like we’ve been here before, you’d be right. This time last year analysts were expecting the great soybean steal to happen because the crop was already offering better premiums. And while growers did sow more of the oilseed than ever before, the plantings came in just shy of matching corn as temperate weather favored the grain.

So what’s different this year? Drought.

About 16 percent of the corn belt is already experiencing drought conditions, with more dry weather forecast into the start of the growing season. Soybeans, wheat and cotton are all more drought-tolerant than corn.

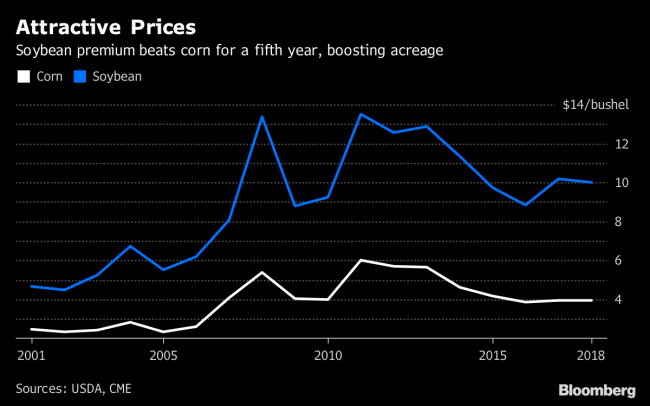

Price Premiums

Prices are also still favoring soybeans, with futures for this year’s crop trading about 2.5 times higher than corn contracts. This is the fifth straight year that the oilseed is offering better returns.

After years of depressed crop prices, those premiums are more important than ever -- just ask Julie Burgod. The 52-year-old farms 4,500 acres and raises calves near Ipswich, South Dakota, with her husband and son. They already plan to slash corn acres in half to make way for soybeans, because the grain “doesn’t pay the bills.” Burgod also owns a crop insurance agency and said many of her clients are echoing the sentiment.

“Soybeans are king, and corn is queen,” Burgod said. “We also are skittish about the dry soils coming into 2018.”

The U.S. Department of Agriculture will release its first planting estimates for the season at its annual outlook conference that begins Thursday in Arlington, Virginia.

Plains Drought

Dry weather is most acute in the northern Great Plains. In North Dakota, drought conditions cover 65 percent of the state, compared with zero last year, according to the U.S. Drought Monitor.

The arid soils are limiting planting options, according to Jim Diepolder, a farmer and seed and farm-chemical dealer near Willow City, North Dakota. The conditions reduce the chances of corn crops generating the yields needed for farmers to break even. Barley is also less attractive after a string of bumper crops boosted inventories, prompting beer companies to cut supply contracts.

Diepolder is planting no corn this year, 50 percent less barley and replacing those acres with another grain that’s forecast to see planting gains: wheat. He’ll also seed more canola. Both crops are considered drought resistant.

“I watch the weather and I watch market prices, but weather is the key,” Diepolder said “The drier it gets, the more spring wheat will get planted because it’s a good drought crop. You have to have something to sell at harvest.”