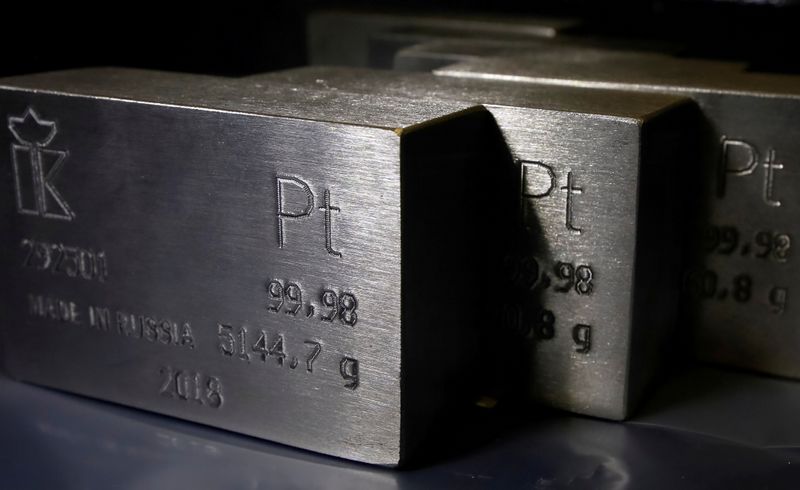

Investing.com -- UBS has released its market outlook for platinum group metals (PGMs), forecasting that platinum will outperform palladium in 2025, although both are expected to lag behind gold and silver.

The report suggests that industrial activity will be a key factor driving the white metals market.

The bank anticipates that central bank rate cuts and a likely weaker US dollar will positively impact the market, while potential tariffs could pose a negative threat. Nonetheless, UBS maintains a moderately positive price outlook for platinum, partly driven by the automotive sector.

“While auto production was disappointing in 2024, there is room for improvement in 2025 if economic activity increases,” UBS strategists Giovanni Staunovo and Wayne Gordon said in a note.

Lower interest rates are expected to make vehicle purchases more affordable, which, coupled with the need to replace aging vehicles, should support autocatalyst demand.

Another positive factor, especially outside China, is the slower pace of vehicle electrification, which is expected to sustain strong demand for autocatalysts.

UBS predicts a supply deficit in platinum of 500,000 ounces, or 6.4% of demand, for 2025, marking the third consecutive year of shortage following deficits of 700,000 ounces in 2024 and 760,000 ounces in 2023.

The bank raises the question of when the reduction in accumulated above-ground inventories will be sufficient for prices to reflect market tightness. Current estimates by the World Platinum Investment Council put these inventories at 3.5 million ounces, with UBS's projections suggesting a decrease to 3 million ounces by the end of 2025.

“We think above-ground inventories need to go even lower, closer to 2 million ounces, to see prices reactive more strongly to an undersupplied market,” strategists continued.

They expect a lower mine supply but an increased scrap supply. While demand for autocatalysts is predicted to rise, UBS forecasts stable jewelry demand and a modest decrease in industrial demand for the year.

Prices for metals and oil in the US surged beyond international benchmarks this week as traders speculate that President-elect Donald Trump may introduce tariffs on imports.

In recent weeks, significant price gaps have emerged between New York and London markets for metals like copper, silver, and platinum. Similarly, oil price differentials between the US and Canada have widened.

These shifts reflect growing uncertainty about the direction of US trade policy under the new administration. The market volatility is creating opportunities for traders to source cheaper materials abroad and bring them into the US.