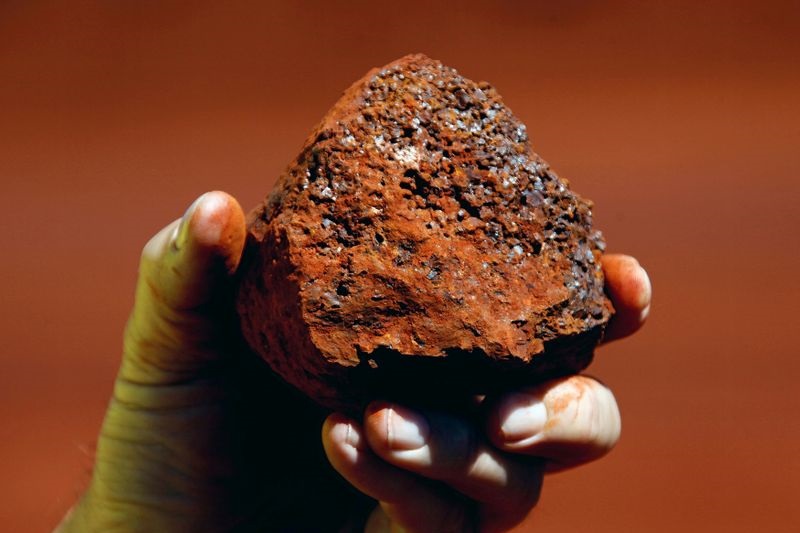

Investing.com - Iron ore experienced its first decline in nine sessions, dropping nearly 5% in Singapore. This decrease is attributed to a warning from Goldman Sachs Group Inc (NYSE:GS)., stating that continued weakness in China's property market would likely have long-term negative effects on the nation's economic growth.

Goldman Sachs' note highlighted ongoing issues within Chinese real estate, particularly involving lower-tier cities and private developer financing. The investment bank indicated that there was no immediate solution for these problems, suggesting an "L-shaped" recovery for the property sector. This comes after iron ore prices had risen by 14% over eight consecutive sessions due to increased efforts by Beijing to stimulate their stalled economy and growing hopes for policies aimed at improving the housing market – a crucial demand source for iron ore used in steel production.

Despite these recent gains, Goldman Sachs does not foresee further housing-specific stimulus measures being implemented by Beijing. Instead, they predict that China will focus on reducing its economic and fiscal dependence on the property sector.

According to research firm Mysteel, China's daily crude steel output is expected to fall slightly during early June compared with late May numbers and down 1.6% from last year when virus-related restrictions were still impacting the economy.