By Oliver Gray

2021 may have marked a true turning point in markets, as covid lingered but took a back seat to the threat of inflation in investors' minds, crypto resurged, meme stocks were a thing, and stocks continued to go up. 2022 could thus mark a new market era: inflation, Central Bank tightening, renewed capital investment, wage pressure, and so on.

To prepare for the year ahead, we’ve assembled Investing.com’s global team of journalists and writers to give you a global take on what’s to come. Over the holiday period, we’ll publish outlooks from our team about the markets across the board - from currencies to stocks, cryptos to commodities, Europe to Asia to the Americas, and beyond. Our aim is to give you a broad perspective on how 2021 wrapped up and where that leaves traders and investors entering 2022, whether it’s a new market regime or more of the same. Check out our full series here.

Investing.com - Commodity prices have been on the rise once again in recent weeks amid growing inflation pressures as central banks around the world begin tightening their respective monetary policies, while the U.S. Federal Reserve accelerated its tapering timeline aggressively in preparation for higher interest rates in 2022.

XAU/USD is currently trading around the $1800 mark, 13% below record highs touched in August 2020.

Iron ore was trading 55% below its record highs touched in July 2021 as strict controls on output and power usage by Chinese state planners dented both supply and demand for the metal. However, according to S&P Global Market Intelligence, the price outlook for metals remains very positive looking towards 2025, with further demand stemming from the electric vehicles energy transition.

"The metals sector is set to continue its rebound from the effects of the COVID-19 pandemic through 2022. Pent-up consumer spending, government stimulus efforts and the accelerating energy transition will continue to drive demand, prices and exploration budgets," S&P Global Market Intelligence noted in its Metals and Mining Outlook report.

A Strong Year For Commodities, If Uneven

As 2022 nears, the pandemic recovery continues to keep metals prices elevated, which is maintaining investor interest in the mining sector. However, the increase will not be felt evenly across all mining commodities. China’s recent decarbonization drive has restricted Chinese steel production in the second half of 2021, with negative implications for iron ore demand and prices. The Chinese steel sector, which accounts for an estimated 15% of the country’s carbon emissions, aims to reach peak emissions by 2025 and to achieve a 30% reduction from the peak by 2030 in accordance with the country’s overall plan for a carbon emissions peak by 2030 and carbon neutrality by 2060. China’s decarbonization push is

expected to cause blast furnace closures, leading to a reduction in Chinese pig iron output next year. Demand for high-grade iron ore is expected to benefit however, due to the lower impurities and higher productivity.

Many producers are having a banner year in 2021 as strong prices for most commodities combined with recovering production fuels healthy margins. While this trend is expected to continue throughout 2022, downside risks are emerging with inflationary pressures likely to impact many operations, amid increasing input costs of fuel, electricity and equipment.

Meantime, 2021 is expected to set another record for global electric vehicle sales, supported by increasing model availability, improvements in battery technologies, consumer incentives and stricter emissions regulations for producers. A prolonged semiconductor chip shortage constrained full EV sales potential in 2021, both of which are expected to extend into 2022. Lithium Carbonate prices have surged 350% year to date as unexpected demand increases combined with a slow expansion in supply. Active lithium M&A and unprecedented financing for junior and intermediate explorers in 2021 are likely to improve medium-term supply but demand-supply mismatches are set to continue into next year as demand increases.

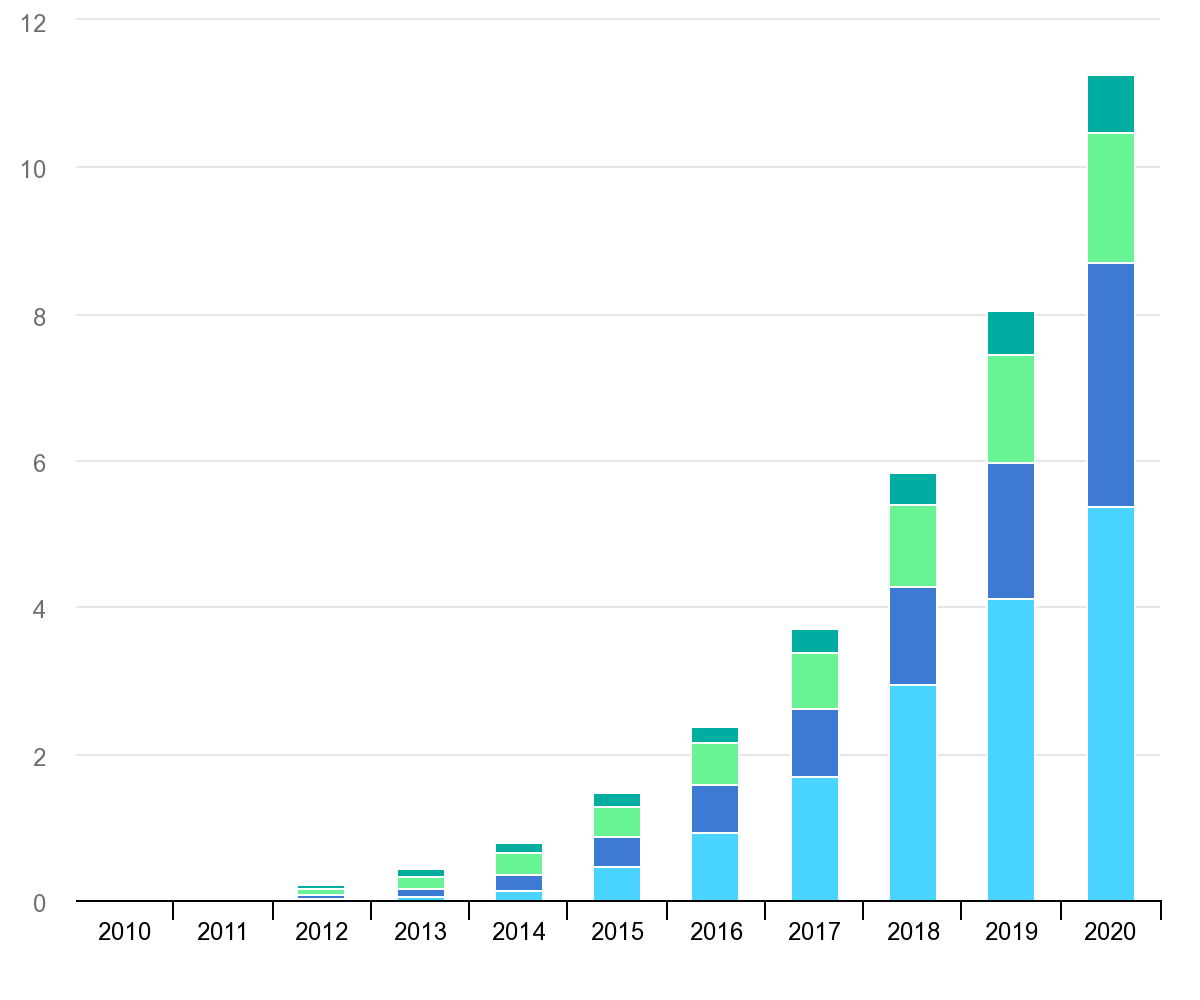

See image above. Source: IEA, Global electric vehicle stock by region, 2010-2020

Copper and zinc prices also surged to record highs this year, as power shortages in China curtailed refinery production. Although the energy crisis may take some time to resolve, sustaining elevated prices, it could negatively impact economic growth in 2022. On the supply side, mined copper output is expected to rise next year, relieving tightness in the concentrate market.

Refined copper demand is expected to outpace growth over the next four years as the metal’s significant uses in solar photovoltaic panels, wind power generation and electric vehicle production, make it a key beneficiary of the energy transition. In addition, rising demand is expected due to expanding electrification infrastructure and upgrades to telecommunications infrastructure, particularly in China and the U.S. Although zinc demand in the energy transition will be a corollary to copper demand, zinc is used in renewables to protect against corrosion, and there remains the possibility of advancements in the zinc energy battery storage space. These advancements are still subject to the challenges of lower life cycle and rechargeability compared with lithium-ion batteries.

Above-Average Prices For Years

While S&P analysts predict easing metals prices in 2022 from their current highs, medium-term supply constraints are setting the stage for historically above-average prices through to 2025 — driven predominantly by increasing demand for materials used in the accelerating global energy transition. Supply constraints are expected to persist despite intensive exploration efforts, which are predicted to expand further in 2022, while exploration efforts continue to focus on regions that have largely mitigated the pandemic’s impacts. It should be noted, however, that few of the resulting discoveries will be developed in time to meet medium-term supply requirements. Faced with persistent if moderating demand, the industry is set up for a period of sustained growth.

Read also: 5 Key Factors To Watch For Oil In 2022

See our full outlook series here.